In 2024, the global Higher Education software market grew to $9.2 billion, marking an 8.4% year-over-year increase. The top 10 vendors accounted for 45.4% of the total market. Microsoft led the pack with an 8.5% market share, followed by Oracle, Workday, and SAP.

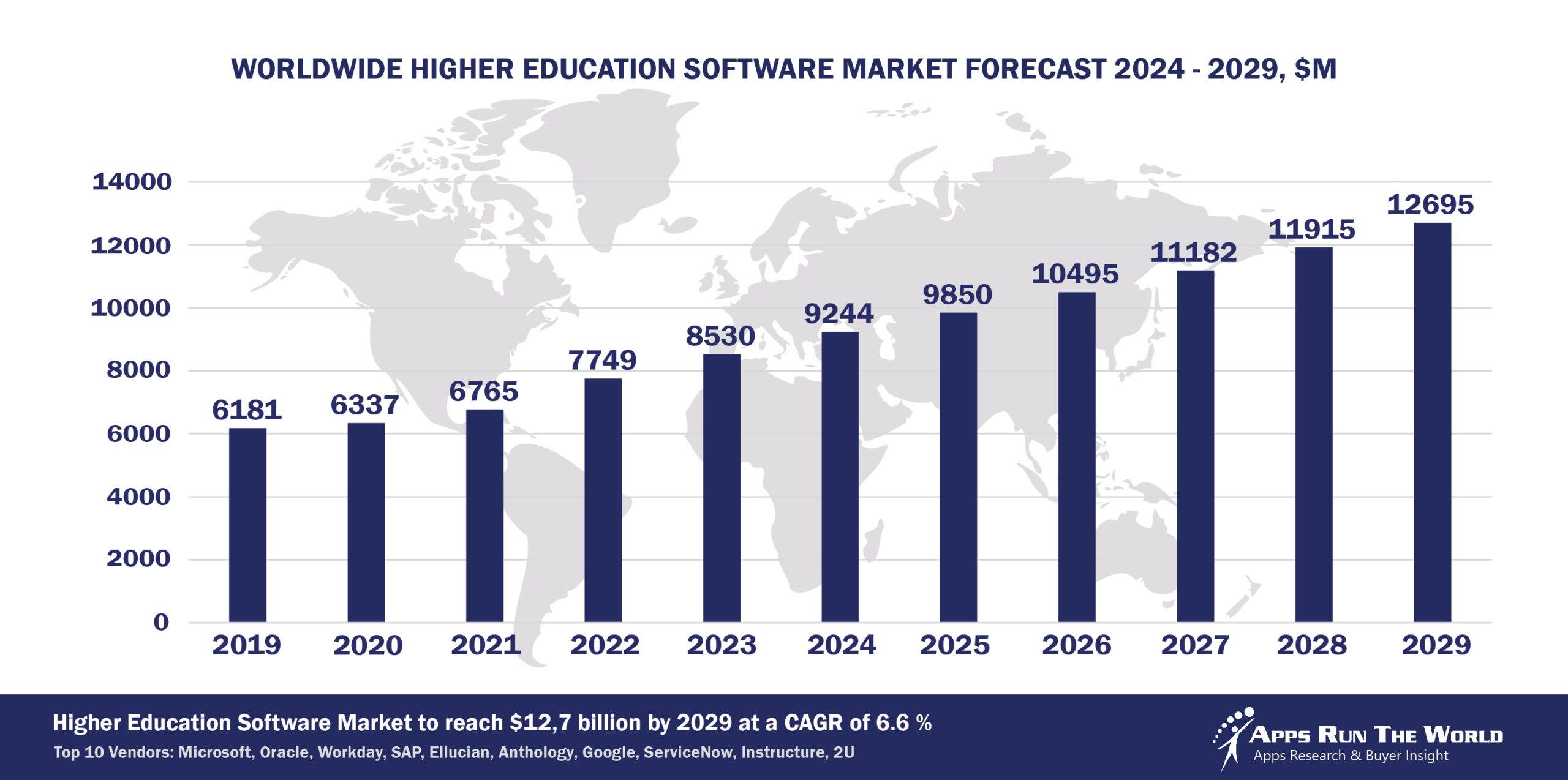

Through our forecast period, the Higher Education applications market size is expected to reach $12.7 billion by 2029, compared with $9.2 billion in 2024 at a CAGR of 6.6%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Higher Education (colleges and universities, technical and vocational, distance learning) – Student Information System, Learning Management, Fund Accounting System, Higher Education Administration, Financials, HR, Procurement

Large-scale projects to implement new student information systems continue unabated as the global education market embraces the convergence of mobile learning, international testing standards as well as online instructions.

Top 10 Higher Education Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Higher Education software providers included in the report are ACI Worldwide, Inc., Adobe, Ansys Inc., Atlassian, Articulate, Autodesk, Axway, Capita Software, Cisco Systems, Civica, Conga, Constellation Software Inc., Cvent, Dominknow, Desire2Learn, DocuSign, Inc., Dropbox, Edmentum, ESM Solutions Corporation, Espressive, FIS Global, Google, Genesys Telecommunications Laboratories, Huron, IBM, Infinite Campus, Infor, Intuit Inc., Ivanti, Jenzabar, Laserfiche, LivePerson Inc., Nelnet, Inc., Open Text Corporation, PowerSchool Group LLC, Roper Technologies, Inc., Sage, Salesforce, SAS Institute, Selerix Systems, Inc, ServiceNow, Shiftboard, Skyward, Smartsheet, Squiz, TalentCircles, TechnologyOne, TalentMap, TeamDynamix, TMA Systems, Tyler Technologies, UNIT4, UKG, and others.

Vendor Snapshot: Higher Education Market Leaders

Microsoft

Microsoft

Microsoft’s education platform is evolving into an AI-driven hub. Recent updates have brought advanced generative models into campus workflows. The Copilot assistant now runs within the enterprise framework and is rolling out to Teams and Outlook for staff and students, with full data protection and privacy compliance. At the same time, Microsoft has launched a new agent-builder experience on its collaboration platform, BizChat, that lets schools create custom multi-step AI agents without coding, while all interactions remain inside the institution’s secure tenant. Under this strategy, Microsoft is unifying Teams, SharePoint and the Power Platform into one intelligent campus infrastructure, enabling everything from conversational teaching assistants to automated analytics pipelines to be assembled via low-code tools.

Oracle

Oracle has made AI agents central to its higher-ed ERP strategy. The company unveiled dozens of role-based AI agents embedded in its cloud applications, covering areas like finance, HR and student administration, that can autonomously handle tasks without human intervention. Alongside this, Oracle introduced an Agent Studio on its Fusion Cloud platform that lets schools modify these built-in agents or build new ones via no-code templates. These moves indicate Oracle is weaving conversational AI and autonomous workflows into its Student and ERP suites, so that a university’s financials, enrollment, and analytics all sit on one AI-augmented platform. In practice, admissions or advising could be managed by chatbots trained on the campus’s data, while budgeting and scheduling become automated processes in the same unified system.

Workday

Workday has embedded AI across its campus management systems. Its student administration module now uses an Illuminate AI engine to automate routine work, making context-aware recommendations, validating data entry, and flagging anomalous records to administrators. Beyond student systems, Workday’s new Illuminate platform leverages the combined power of HR and financial data: it uses generative AI to speed up content creation and anomaly detection, and it even orchestrates end-to-end processes through AI assistants. Workday has also released a conversational assistant, Workday Assistant, that can guide users through complex processes in HR and finance.

SAP

SAP is infusing its enterprise suite with AI copilots and agents. Its latest cloud ERP release pack introduced Joule, an AI copilot in S/4HANA Cloud, that users can interact with in natural language to summarize data, navigate Fiori apps, and get real-time insights. SAP announced it will feed campus ERP data into Microsoft’s Copilot for use inside Office apps, blending SAP data with cloud AI. Meanwhile, SAP is embedding generative AI into adjacent areas. Joule Copilot is being rolled out into SAP Ariba to auto-generate RFIs and contracts. Taken together, SAP’s strategy is to knit together student and financial ERP, travel/expense, and planning into one Intelligent Campus stack, one that offers low-code AI tools on the Business Technology Platform and chat interfaces for everything from automated scheduling to self-service analytics.

Ellucian

Ellucian unveiled Journey, an AI-driven lifelong-learning engine that uses large-language models to map each student’s skill progression and suggest courses aligned to labor-market data. Simultaneously, Ellucian added predictive and generative AI into its analytics suite: its Insights product now includes models to spot at-risk students and a natural-language chatbot to query institutional data. On the operations side, Ellucian introduced Intelligent Processes, a no-code workflow engine that lets registrars and admin staff chain together cross-department tasks without custom code. Ellucian is unifying its SIS, ERP and CRM into an AI-augmented SaaS platform: data from students, faculty and finance feed these AI modules, so that the system can automate communications, analytic reports, and other services end-to-end.

Anthology (Blackboard, Campus Management, Campus Labs, and iModules)

Anthology, the parent of Blackboard, Campus Labs, Campus Management and others, is converging AI into a unified campus suite. Blackboard LMS now features AI-enabled authoring and tutoring tools, instructors get an AI design assistant and multimedia studio for course content, and even persona-based chatbots that answer student questions in context. The same underlying platform powers predictive analytics and CRM. The Reach advisor CRM now includes an AI-powered student engagement scoring model, and Anthology’s new analytics engine, Illuminate, fuses data across LMS, SIS and CRM to deliver comprehensive insights. Rather than siloed products, Anthology is steering toward one intelligent campus stack: embedded generative AI creates lesson content and student outreach, while conversational interfaces and low-code APIs let institutions hook Canvas/Blackboard data into custom LLMs or analytics pipelines.

Google’s launched an enterprise Agentspace platform where schools can build or deploy pre-made AI assistants with no code, agents that automatically generate reports or explore data. On the data side, Google Cloud Next 2025 revealed AI agents built into BigQuery and Looker, a Data Engineering agent that automates ETL pipelines and a conversational BI agent for Looker dashboards, both powered by Google’s Gemini LLM and a new BigQuery Knowledge Engine. Campuses can now ask their data questions directly and get instant analysis. These developments complement Gemini copilots in Google Workspace and Classroom, all pointing to Google’s vision of an autonomous data-to-AI pipeline, from collected analytics to campus agents that can plan tasks, schedule meetings, or tutor students through chat.

ServiceNow

ServiceNow extended Now Assist across modules, the new Creator Studio can auto-generate complete apps, workflows and service catalogs from natural-language prompts. At the same time, ServiceNow announced tight integration with Microsoft’s Copilot, AI guidance in workflow approvals and ITSM tickets will surface in Teams and Outlook as well as in ServiceNow, meaning users get conversational help regardless of interface. The company is also automating IT operations and HR cases with AI-driven virtual agents.

Instructure, Inc.

Instructure is rapidly infusing AI into the Canvas learning platform. Canvas gained new AI tools for instructors; it can auto-summarize online discussions, translate content on the fly, and perform semantic smart search over courses using embedded AI models. Instructure launched an Intelligent Insights analytics feature so schools can get automated reports on student performance and course health. Canvas is shaping up as an all-in-one classroom platform with built-in generative content assistants and chat interfaces, rather than a set of disjointed tools, enabling campuses to plug the LMS into custom AI models or dashboards through open APIs.

2U, INC.

2U’s strategy is to embed AI into the online learning experience on its edX platform. edX introduced Xpert, a ChatGPT-based tutor inside courses that can break down lectures, answer follow-ups, and quiz learners in real time. It also launched an edX ChatGPT plugin that lets prospective students discover edX courses via conversation. These AI agents tie directly into 2U’s broader ecosystem, learners who interact with Xpert generate data that informs personalized course recommendations, and the plugin feeds new enrollments from chatbot-driven discovery. Combined with an expanding suite of AI-focused programs, 2U is offering an end-to-end AI-augmented journey, from using chatbots for course advice to delivering personalized tutoring, effectively unifying content, support and analytics through generative AI.

ARTW Technographics Platform: Higher Education customer wins

Since 2010, our research team has been studying the patterns of Higher Education software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Higher Education customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Higher Education customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Education Applications market are available:

- Top 750+ Higher Education Applications Vendors and Market Forecast 2024-2029

- 2024 Higher Education Applications Market By Functional Market (16 Markets)

- 2024 Higher Education Applications Market By Country (USA + 45 countries)

- 2024 Higher Education Applications Market By Region (Americas, EMEA, APAC)

- 2024 Higher Education Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Higher Education Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Higher Education Applications Market By Channel (Direct vs Indirect)

- 2024 Higher Education Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Higher Education Software Vendors, Market Size & Forecast

Q1. What is the global Higher Education software market size in 2024?

A: The global Higher Education software market reached $9.2 billion in 2024, marking an 8.4% year-over-year increase.

Q2. Who are the top 10 Higher Education software vendors in 2024, and what share do they hold?

A: The top 10 vendors are Microsoft, Oracle, Workday, SAP, Instructure, Ellucian, Blackboard, Anthology, ServiceNow, and Cornerstone OnDemand, together accounting for 45.4% of the Higher Education software market in 2024.

Q3. Which vendor leads the Higher Education software market in 2024?

A: Microsoft leads the Higher Education software market in 2024 with an 8.5% market share.

Q4. What is the forecast for the Higher Education software market through 2029?

A: The market is projected to reach $12.7 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.6%.

Q5. What applications are included in the scope of the Higher Education software market?

A: The scope includes Student Information Systems (SIS), Learning Management Systems (LMS), Fund Accounting Systems, Higher Education Administration, Financials, HR, and Procurement.

Q6. Which other Higher Education software vendors are covered beyond the top 10?

A: The report also profiles vendors such as D2L, Moodle, and Schoology, among others, offering specialized solutions for higher education institutions.

Q7. When was this Higher Education software report published, and by whom?

A: The Top 10 Higher Education Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Confidentialmind, a Finland based Professional Services organization with 12 Employees

- CETYS University, a Mexico based Education company with 1240 Employees

- Willis Towers Watson, a United Kingdom based Banking and Financial Services organization with 49000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft