In 2024, the global Education software market grew to $15.4 billion, marking an 8.3% year-over-year increase. The top 10 vendors accounted for 39% of the total market. Microsoftled the pack with an 8.5% market share, followed by Oracle, PowerSchool Group, and SAP.

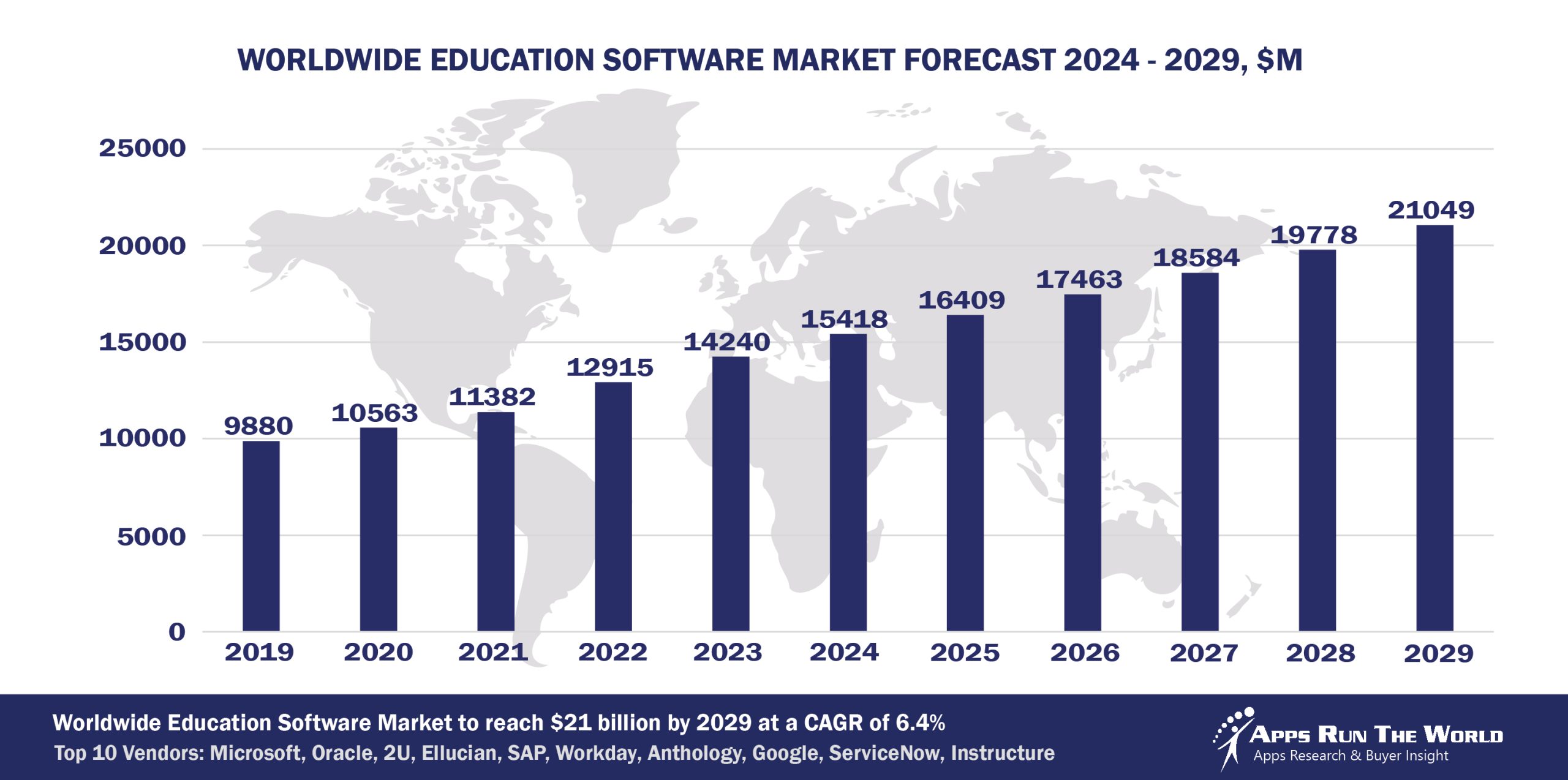

Through our forecast period, the Education applications market size is expected to reach $21 billion by 2029, compared with $15.4 billion in 2024 at a CAGR of 6.4%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Education (K-12 schools, colleges and universities, technical and vocational, distance learning) – Student Information System, Learning Management, Fund Accounting System, Higher Education Administration, Financials, HR, Procurement

Large-scale projects to implement new student information systems continue unabated as the global education market embraces the convergence of mobile learning, international testing standards as well as online instructions.

Top 10 Education Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Education software providers included in the report are: ACI Worldwide, Inc., Adobe, Ansys Inc., Articulate, Autodesk, Axway, Capita Software, Cisco Systems, Civica, Constellation Software Inc., Cvent, Dominknow, Dropbox, Edmentum, ESM Solutions Corporation, Espressive, FIS Global, Genesys Telecommunications Laboratories, Huron, IBM, Infinite Campus, Infor, Intuit Inc., Ivanti, Jenzabar, Laserfiche, LivePerson Inc., Open Text Corporation, PowerSchool Group LLC, Roper Technologies, Inc., Sage, Salesforce, SAS Institute, Selerix Systems, Inc, ServiceNow, Shiftboard, Skyward, Smartsheet, Squiz, Skillsoft, TalentCircles, TalentMap, TeamDynamix, TMA Systems, Tyler Technologies, UNIT4, Zoom Video Communications, and others.

Vendor Snapshot: Education Market Leaders

Microsoft

Microsoft

Microsoft continues to embed agentic AI into its education ecosystem through Microsoft 365, Teams, and Power BI, with a focus on collaborative learning and personalized academic workflows. AI Copilot functionalities are being integrated into both administrative and instructional tools, enabling autonomous planning, grading, and student performance tracking.

Oracle

Oracle is embedding autonomous agents across its Student Cloud and Oracle Cloud Infrastructure to support adaptive curriculum planning, financial aid optimization, and enrollment management. AI-enhanced analytics via Oracle Analytics Cloud are transforming student lifecycle oversight with predictive retention models. Their roadmap includes agent-based orchestration for faculty scheduling and student engagement, with extensibility supported through Oracle’s low-code Visual Builder Studio.

PowerSchool Group LLC

PowerSchool prioritizes AI-enhanced operational efficiencies and early warning systems within its K–12 SIS and ERP offerings. The platform utilizes predictive analytics and low-code workflow automation to improve student outcomes and streamline district management, though fully autonomous agents are still emerging.

SAP

SAP’s education strategy focuses on harmonizing administrative and learning data through S/4HANA and the Business Technology Platform. The introduction of Joule, SAP’s AI assistant, allows institutions to embed agentic functionality into processes like procurement, staff onboarding, and student services. SAP supports no-code agent development for education-specific use cases such as resource allocation, scholarship management, and curriculum optimization.

Workday

Workday is advancing agentic AI capabilities in its Workday Student and Adaptive Planning platforms, particularly for tuition forecasting, course scheduling, and student progression tracking. Prism Analytics delivers autonomous data pipelines that enhance enrollment and institutional planning with secure AI governance and customizable low-code agents.

Anthology (Blackboard, Campus Management, Campus Labs, and iModules)

Anthology combines AI-driven analytics from Anthology Illuminate and Blackboard personalization to unify LMS, CRM, and finance systems. Its agentic features assist academic advising, retention efforts, and donor engagement, moving toward autonomous course delivery and stakeholder communication.

Ellucian

Ellucian’s investment in AI-driven student success tools is reshaping its Banner and Colleague ecosystems. CRM Recruit and CRM Advance are being enhanced with autonomous agents for enrollment tracking and alumni engagement. Their partnership with cloud providers is accelerating integration of agentic analytics and workflow orchestration, although current deployments remain largely advisory and semi-automated.

Instructure, Inc.

Instructure is expanding Canvas LMS with agentic capabilities that support real-time assessment feedback, student sentiment analysis, and learning path customization. Acquisitions like MasteryConnect and Elevate K–12 Analytics enhance its capacity to deploy intelligent agents for instructional support and district-wide performance monitoring. Instructure is gradually moving toward self-adapting learning environments supported by conversational interfaces and no-code automation.

Google embeds AI agents across Workspace and Google Cloud, supporting collaboration, identity management, and educational analytics. Looker and BigQuery facilitate autonomous workflows for reporting and adaptive learning content, emphasizing open AI models and low-code scalability.

ServiceNow

ServiceNow brings agentic AI to education IT and HR through its Now Platform, enhancing administrative workflows with virtual agents for help desks, faculty onboarding, and campus service requests. Educational institutions are leveraging low-code Studio capabilities to create tailored AI agents that span ITSM, CSM, and facilities management. Autonomous orchestration is gaining traction, especially in hybrid campus operations and student service optimization.

ARTW Technographics Platform: Education customer wins

Since 2010, our research team has been studying the patterns of Education software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Education customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Education customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Education Applications market are available:

- Top 750+ Education Applications Vendors and Market Forecast 2024-2029

- 2024 Education Applications Market By Functional Market (16 Markets)

- 2024 Education Applications Market By Country (USA + 45 countries)

- 2024 Education Applications Market By Region (Americas, EMEA, APAC)

- 2024 Education Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Education Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Education Applications Market By Channel (Direct vs Indirect)

- 2024 Education Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Education Software Vendors, Market Size & Forecast

Q1. What is the global Education software market size in 2024?

A: The global Education software market reached $15.4 billion in 2024, growing 8.3% year‑over‑year.

Q2. Who are the top 10 Education software vendors in 2024 and their combined share?

A: The top 10 vendors are Microsoft, Oracle, PowerSchool Group, SAP, Workday, Google, ServiceNow, Instructure, Blackboard, and Ellucian, together capturing about 39% of the Education software market in 2024.

Q3. Which vendor leads the Education software market in 2024?

A: Microsoft leads the Education software market in 2024 with the highest individual market share.

Q4. What is the Education software market outlook through 2029?

A: The Education software market is projected to grow to $21.0 billion by 2029, at a compound annual growth rate (CAGR) of 6.4%.

Q5. What applications are included in the scope of the Education software market?

A: It includes student information systems, learning management, fund accounting, higher education administration, financials, HR, and procurement across K‑12, colleges, universities, technical & vocational, and distance learning.

Q6. Which other Education software vendors are covered beyond the top 10?

A: The report also profiles vendors such as D2L, Canvas, Moodle, Clever, and Schoology among the additional players in the Education software space.

Q7. When was this Education software report published, and by whom?

A: The Top 10 Education Software Vendors, Market Size & Forecast 2024‑2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Techcom Bank, a Vietnam based Banking and Financial Services organization with 5000 Employees

- Borough of Manhattan Community College, a United States based Education company with 2200 Employees

- Monash University, a Australia based Education organization with 17000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft