In 2024, the global Communications software market grew to $15.1 billion, marking a 10.4% year-over-year increase. The top 10 vendors accounted for 39.4% of the total market. Oracle led the pack with a 7.8% market share, followed by Ericsson, Microsoft, and Salesforce.

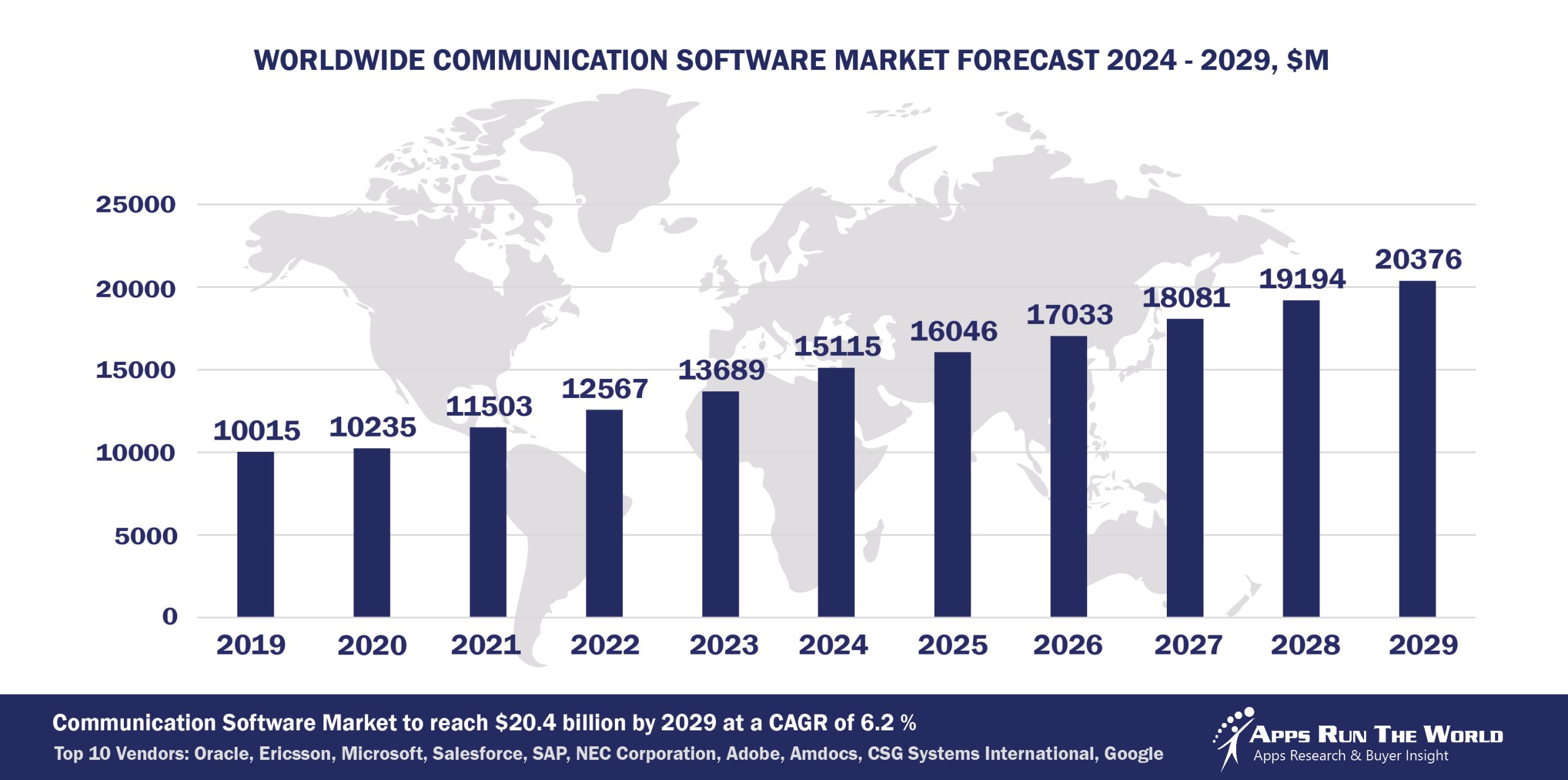

Through our forecast period, the Communications applications market size is expected to reach $20.3 billion by 2029, compared with $15.1 billion in 2024 at a CAGR of 6.2%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Communications (Telecom services providing point-to-point contact) – Converged billing, Multi-party settlement, OSS, BSS, Financials, HR, Procurement

OSS and BSS replacements are likely to grow modestly as communications firms are slow to embrace 5G and the Cloud. New network management tools, subscription models, and apps that enable carriers to better monetize their subscription base may see higher growth.

Top 10 Communications Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Communications software providers included in the report are ADP, Amazon Web Services (AWS), Ansys Inc., Atlassian, Autodesk, Cisco Systems, Constellation Software Inc., Cision, Citrix, Cornerstone OnDemand, Cadence Design Systems, CSG Systems International, DATEV, Dassault Systemes, DocuSign, Inc., Dropbox, Fiserv, Genesys Telecommunications Laboratories, Google, Hexagon, HubSpot, IBM, Intuit Inc., Khoros, Mavenir, Nice Systems, Optiva Inc., Open Text Corporation, Paycom, Paylocity, Pegasystems, Qlik, RingCentral, Roper Technologies, Inc., Sage, SAS Institute, ServiceNow, Sharpen Technologies Inc., Siemens Digital Industries Software, Subex UK Limited, Synopsys, Synchronoss, TEOCO, Teradata Corporation, Trimble, Twilio, Verint Systems Inc., Workday, Zendesk, Zoho Corp., Zoom Video Communications, and many others.

Vendor Snapshot: Communications Market Leaders

Oracle

Oracle

Oracle continues to deepen its telecom vertical footprint by blending its Communications BSS/BRM stack with Cloud ERP and cloud-native analytics, all anchored on strong OCI infrastructure. Oracle launched its 5G Cloud‑Native Network Data Analytics Function, the flagship of the Analytics Suite, which leverages AI/ML to help operators detect anomalies, automate performance insights, and support 5G monetization and network planning.

Ericsson

In June 2025, Ericsson unveiled a major evolution of its OSS/BSS portfolio, embedding AI, intent-driven automation, and generative AI across products such as its Telco DataOps Platform, Charging & Billing Evolved, Service Orchestration & Assurance, Intelligent IT Suite, and Core Commerce. Ericsson’s OSS/BSS platforms support over 300+ CSPs globally.

Microsoft

Microsoft is aligning its productivity, ERP, and marketing platforms tightly through AI and agentic automation, positioning Microsoft 365, Dynamics 365 as a unified foundation for communications industry clients. Microsoft introduced Copilot-first interfaces and autonomous agents for tasks like account reconciliation, period-close workflows, and financial planning in Dynamics 365 Finance.

Salesforce

Salesforce Communications Cloud offers a comprehensive, AI-augmented CRM/BSS platform purpose-built for the communication industry, spanning billing inquiry handling, order orchestration, CPQ, service, and churn management, with real-world CSP deployments and channel integrations. Sales Cloud remains Salesforce’s flagship CRM for enterprise sales, including telecom and media providers. As part of the broader AI investment, Salesforce closed over 1,000 paid deals for Agentforce by late 2024, underscoring rapid enterprise traction.

SAP

SAP is significantly deepening its footprint in the communication and telecom space by deploying modern cloud ERP (S/4HANA), integrated AI services, and communications-aware platforms that support 5G, IoT, and edge use cases. The key developments to watch are the rollout of Business Data Cloud, the Joule agent ecosystem, and the Vonage/BTP integrations showcased at Mobile World Congress.

NEC Corporation

Netcracker continued to drive innovation without new acquisitions, instead expanding organically across Europe and the Middle East. Notable full-stack deployments in Andorra Telecom and Cyta (Cyprus) demonstrated its strength in cloud-native migrations, delivering converged BSS/OSS stacks on AWS to support 5G, fiber, and B2B/B2C services.

Adobe

Adobe Experience Cloud (formerly Marketing Cloud) continues its transition from analytics rootstock into a full-stack, AI‑powered marketing intelligence engine. With innovative agentic AI, major investment in generative workflows, and enduring enterprise scale, it’s a strong platform for communications companies needing personalized, scalable, multi-channel marketing and analytics infrastructure. Communications providers increasingly turn to Adobe’s AI‑driven Experience Cloud for customer journey orchestration, personalized marketing, and global campaign management.

Amdocs

In March 2025, Amdocs launched Amdocs Studios, a unified digital services business tailored for telcos, blending experience engineering, data & GenAI, cloud, and quality engineering to accelerate digital transformation from concept to production. This studio leverages the recent acquisition of Profinit, enabling enhanced Generative AI and data science capabilities tailored for Communication Service Providers.

CSG Systems International

CSG Systems remains a trusted provider of BSS, monetization, and customer experience solutions for the communications industry, with its cloud-native Ascendon platform now increasingly infused with AI-driven capabilities. Leveraging its strong legacy in billing and digital engagement, CSG is enabling telecom operators to automate decision-making, personalize experiences, and optimize revenue streams through advanced analytics and intelligent service orchestration.

Google continues to evolve Workspace by embedding AI into Gmail, Docs, Meet, and Chat through Duet AI. While Google’s AI agents are not fully autonomous, Workspace developers now have access to Vertex AI Agent Builder and AppSheet to create tailored collaborative experiences. The platform is increasingly allowing agents to summarize meetings, generate documents, and facilitate decisions through real-time content synthesis, bridging asynchronous and live collaboration seamlessly.

ARTW Technographics Platform: Communications customer wins

Since 2010, our research team has been studying the patterns of the Communications software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Communications customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Communications customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Communications Applications market are available:

- Top 980+ Communications Applications Vendors and Market Forecast 2024-2029

- 2024 Communications Applications Market By Functional Market (16 Markets)

- 2024 Communications Applications Market By Country (USA + 45 countries)

- 2024 Communications Applications Market By Region (Americas, EMEA, APAC)

- 2024 Communications Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Communications Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Communications Applications Market By Channel (Direct vs Indirect)

- 2024 Communications Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Communications Software Vendors, Market Size & Forecast

Q1. What is the global Communications software market size in 2024?

A: The global Communications software market reached $15.1 billion in 2024, growing 10.4% year-over‑year.

Q2. Who are the top 10 Communications software vendors in 2024 and what share do they hold?

A: The top 10 vendors in 2024 are Oracle, Adobe, SAP, Salesforce, Microsoft, Ericsson, NEC Corporation, Amdocs, CSG Systems International, and Google, collectively accounting for 39.4% of the market.

Q3. Which vendor leads the Communications software market in 2024?

A: Oracle leads the Communications software market in 2024 with approximately 7.8% market share.

Q4. What is the forecast for the Communications software market through 2029?

A: The market is projected to reach $20.3 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.2%.

Q5. What applications are included in the scope of the Communications software market?

A: The scope includes converged billing, multi-party settlement, OSS/BSS, financials, HR, and procurement solutions for communication service providers and related industries.

Q6. Which other Communications software vendors are covered beyond the top 10?

A: The report also profiles vendors such as Cisco, Huawei, IBM, and several regional OSS/BSS providers offering specialized platforms for telecom billing, service orchestration, and analytics.

Q7. When was this Communications report published and by whom?

A: The Top 10 Communications Software Vendors, Market Size and Forecast 2024‑2029 was published July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Impellam Group plc, a United Kingdom based Professional Services organization with 1200 Employees

- Bytedance, a United States based Professional Services company with 100 Employees

- Tencent, a China based Communications organization with 110558 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Oracle

Oracle