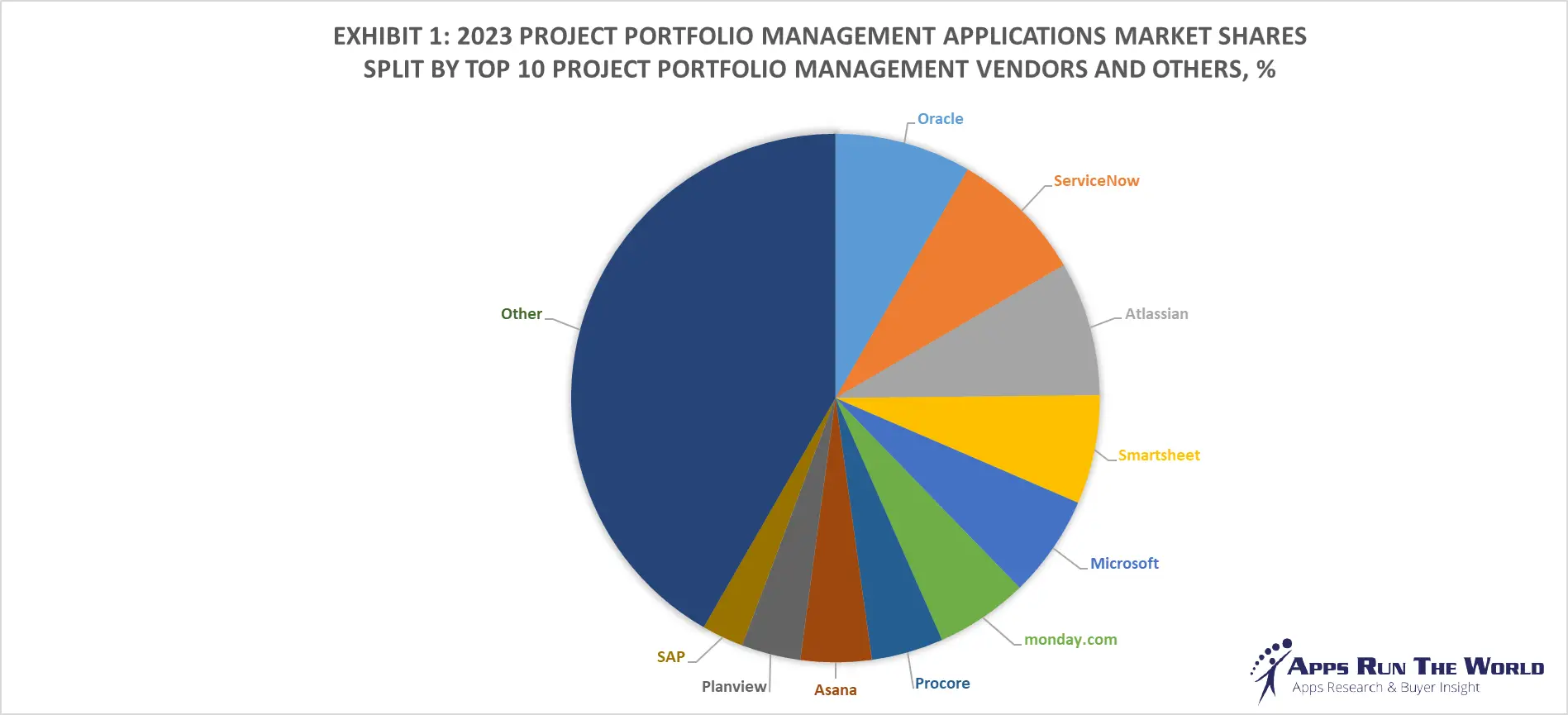

In 2023, the global Project Portfolio Management (PPM) software market surged to nearly $7.8 billion, growing by 14.9%. The top 10 vendors commanded a significant 58.3% market share, with Oracle leading at 8.4%, followed by ServiceNow, Atlassian, Smartsheet, and Microsoft.

Our APPS TOP 500 Market Report (Preview) covers hundreds of PPM software vendors, offering deep insights into market dynamics, vendor strengths, AI investments, customer momentum, and go-to-market strategies providing valuable perspectives on market trends and challenges.

Discover thousands of PPM Customer Wins with the ARTW Technographics Platform, an essential resource for technology enthusiasts, sales business leaders, and data-driven marketing executives, offering curated insights into the evolving landscape of the software industry, including the latest developments in PPM.

Through our forecast period, the PPM applications market size is expected to reach $9.6 billion by 2028, compared with $7.8 billion in 2023 at a compound annual growth rate of 14.4%.

| Exhibit 2: Worldwide PPM Software Market 2023-2028 Forecast, $M | |||

|---|---|---|---|

| Year | 2023 | 2028 | 2023-2028 CAGR, % |

| Total | 7769 | 9650 | 4.4% |

Source: Apps Run The World, June 2024

Top 10 PPM Software Vendors

Project and portfolio management (PPM) applications include those that automate and optimize the initiating, planning/scheduling, allocation, monitoring, and measuring of activities and resources required to complete projects. PPM applications also cover certain aspects of IT service management especially those that involve project portfolio management within the IT domain.

Conventional project management apps are being eclipsed by Cloud-based offerings as market is buoyed by low price point and increased use of multimedia tools for virtual project teams.

Here are the rankings of the top 10 Project Portfolio Management software vendors in 2023 and their market shares.

| Rank | Vendor | 2021 Project Portfolio Management Apps Revenues, $M | 2022 Project Portfolio Management Apps Revenues, $M | 2023 Project Portfolio Management Apps Revenues, $M | YoY Growth | 2023 Project Portfolio Management Market Share, % |

|---|---|---|---|---|---|---|

| 1 | Oracle | Subscribe | Subscribe | Subscribe | 4.3% | Subscribe |

| 2 | ServiceNow | Subscribe | Subscribe | Subscribe | 18.2% | Subscribe |

| 3 | Atlassian | Subscribe | Subscribe | Subscribe | 22.4% | Subscribe |

| 4 | Smartsheet | Subscribe | Subscribe | Subscribe | 28.0% | Subscribe |

| 5 | Microsoft | Subscribe | Subscribe | Subscribe | 9.4% | Subscribe |

| 6 | monday.com | Subscribe | Subscribe | Subscribe | 42.2% | Subscribe |

| 7 | Procore | Subscribe | Subscribe | Subscribe | 31.7% | Subscribe |

| 8 | Asana | Subscribe | Subscribe | Subscribe | 35.2% | Subscribe |

| 9 | Planview | Subscribe | Subscribe | Subscribe | 9.8% | Subscribe |

| 10 | SAP | Subscribe | Subscribe | Subscribe | 8.1% | Subscribe |

| Subtotal | Subscribe | Subscribe | Subscribe | 19.4% | Subscribe | |

| Other | Subscribe | Subscribe | Subscribe | 9.1% | Subscribe | |

| Total | 5605 | 6761 | 7769 | 14.9% | 100.0% |

Source: Apps Run The World, June 2024

Other PPM software providers included in the report are: 24SevenOffice, Access Group, Autodesk, Basecamp, BST Global, Broadcom Inc., Citrix, Computer Methods International Corp., Constellation Software Inc, Dassault Systemes, Datto, Duzon Digitalware, HCL Technologies, IBM, IFS, Ignite Technologies, InEight, KPI Software Inc, Miro, Odoo, Open Text Corporation, Planisware, ProAlpha Business Solutions, Prometheus Group, QuickBase, RIB Software SE, River Logic, Roper Technologies, Runrun.it, Sciforma Corporation, Smartsheet, Sopheon, SS&C Technologies, TeamDynamix, Tigernix Pte Ltd, Trimble, UNIT4, Upland Software, WisageTech, Workcube ERP, Workday, Yonyou, Zoho Corp., and others.

Custom data cuts related to the PPM Applications market are available:

- Top 170+ PPM Applications Vendors and Market Forecast 2023-2028

- 2023 PPM Applications Market By Industry (21 Verticals)

- 2023 PPM Applications Market By PPM Segments and Categories

- 2023 PPM Applications Market By Country (USA + 45 countries)

- 2023 PPM Applications Market By Region (Americas, EMEA, APAC)

- 2023 PPM Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2023 PPM Applications Market By Customer Size (revenue, employee count, asset)

- 2023 PPM Applications Market By Channel (Direct vs Direct)

- 2023 PPM Applications Market By ProductBuyer Intent: Companies Reading this Research ReportARTW Buyer Intent uncovers actionable customer signals, identifying software buyers actively reading this research report. Gain ongoing access to real-time prospects and uncover hidden opportunities. Companies Actively accessing this research report include:

- monday.com, a Israel based Professional Services organization with 2508 Employees

- University Of Saarland, a Germany based Education company with 375 Employees

- Dr. Reddy's Laboratories, a India based Manufacturing organization with 25863 Employees

Logo Company Industry Employees Revenue Country Evaluated Worldwide Enterprise Application Market

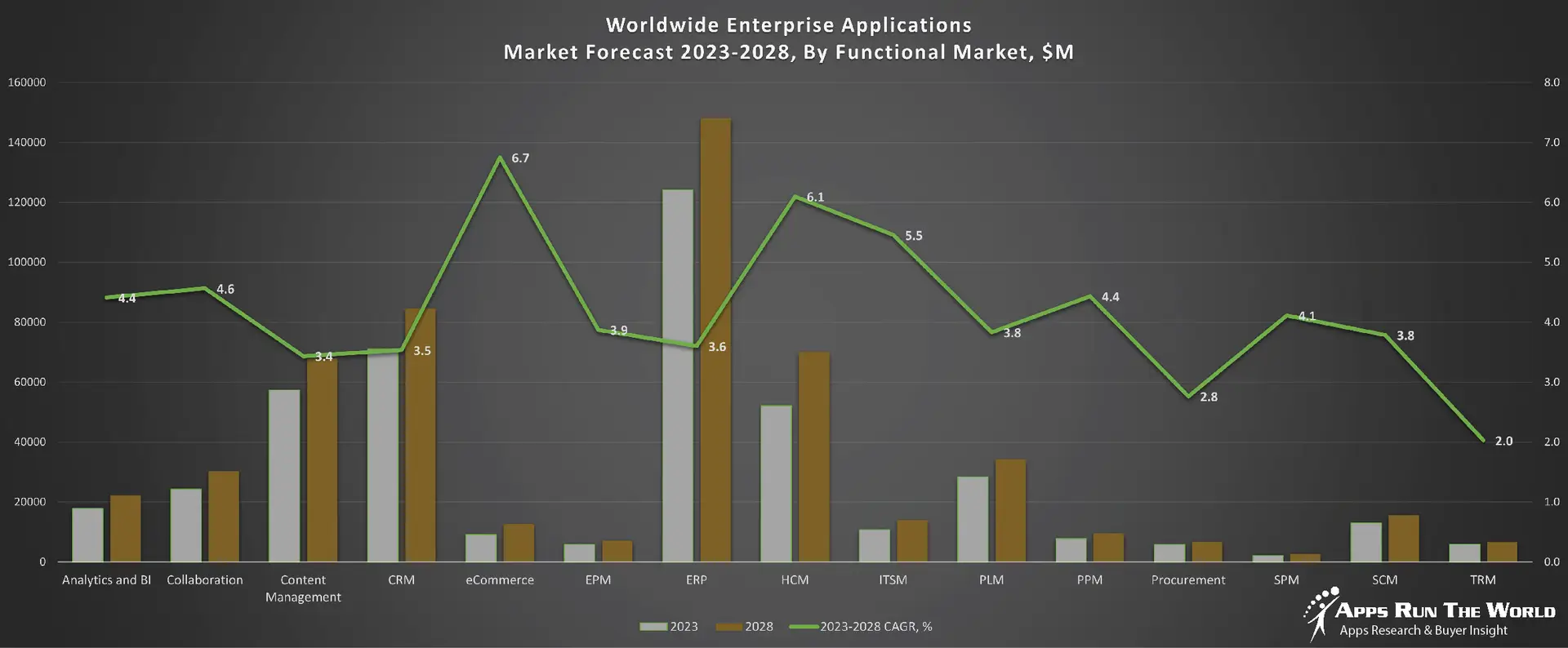

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2023 to 2028, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2023-2028 by Functional Market ($M)

Source: Apps Run The World, June 2024

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like eCommerce, Enterprise Performance Management, Sales Performance Management and Treasury and Risk, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, CRM and PLM.

PPM Win/Loss Analysis As Part Of Enterprise Applications Buyer Insight Customer Database

On the buyer side, customers are investing in Project Portfolio Management systems based on new features and capabilities that are expected to replace their existing legacy systems. In many cases, competitive upgrades and replacements that could have a profound impact on future market-share changes will become more widespread.

Since 2010, our global team of researchers have been studying the patterns of the latest PPM software purchases by customers around the world, aggregating massive amounts of data points that form the basis of our forecast assumptions and perhaps the rise and fall of certain vendors and their products on a quarterly basis.

Updated continuously, our database features extensive win/loss analysis. Each year our research team identifies tens of thousands of these customer wins and losses from public and proprietary sources.

Research results are being incorporated into regular updates in our Enterprise Applications Buyer Insight Customer Database. You can access the Quarterly Win/Loss Analysis Scoreboard and our Enterprise Applications Buyer Insight Customer Database by becoming a subscriber.

Source: Apps Run The World, June 2024

More Enterprise Applications Research Findings

Based on the latest annual survey of 3,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 500 largest Enterprise Applications Vendors (Apps Top 500) ranked by their 2019-2023 product revenues.

Their 2023 results are being broken down, sorted and ranked across 16 functional areas(from Analytics to Treasury and Risk Management) and by 21 vertical industries(from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.