In 2024, the global Hospitality software market grew to $9.6 billion, marking a 11.9% year-over-year increase. The top 10 vendors accounted for 40.8% of the total market. Salesforce led the pack with a 8.6% market share, followed by Adobe, Microsoft, and Amadeus.

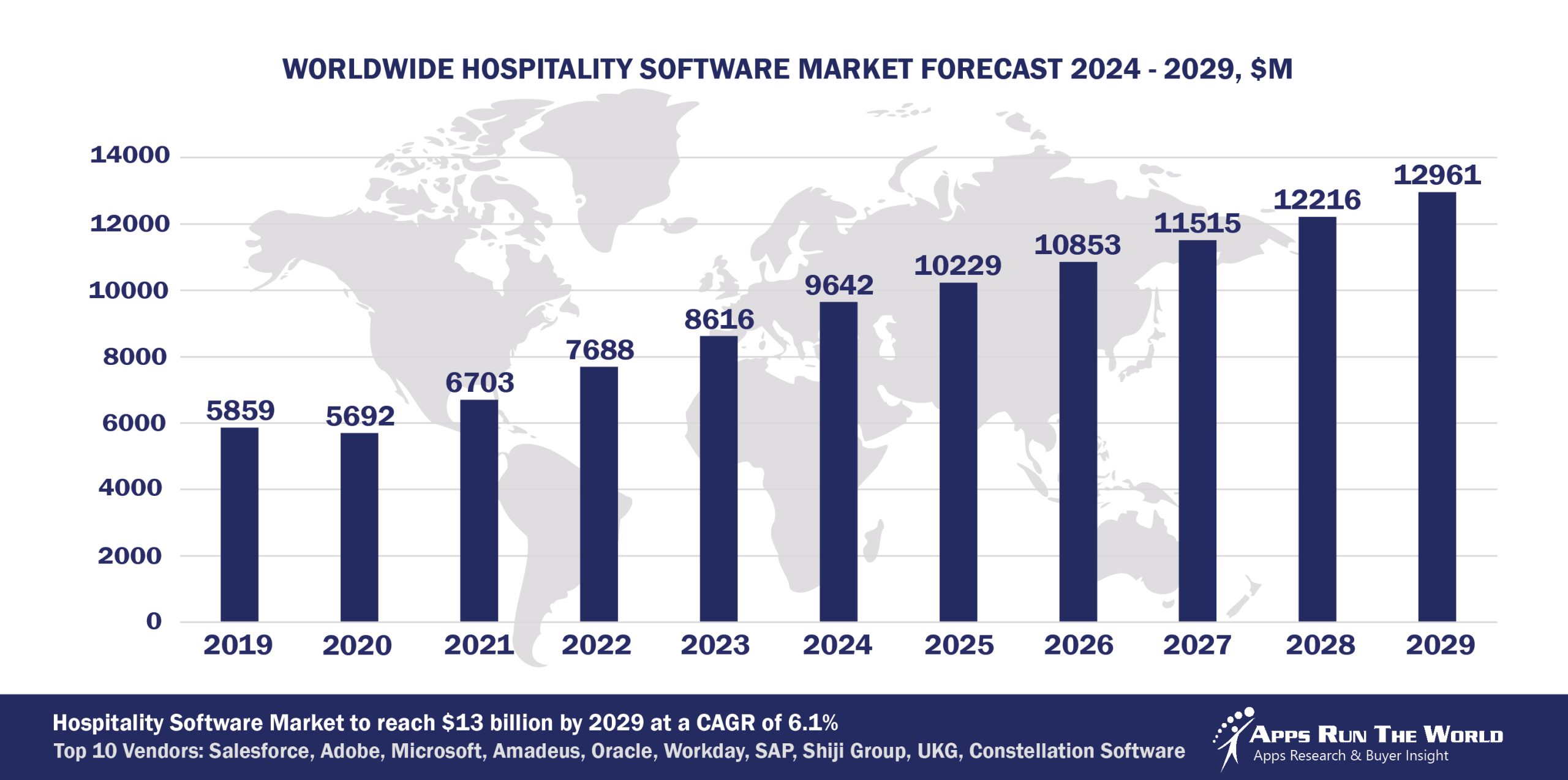

Through our forecast period, the Hospitality applications market size is expected to reach $13 billion by 2029, compared with $9.6 billion in 2024 at a CAGR of 6.1%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Hospitality (hotels, cruises, lodging facilities) – Property Management, Cash Journaling & Gratuity Automation, Revenue Optimization, Hotel distribution, CRS, Channel management, Inventory Management, Financials, HR, POS, Procurement

Mobile and Cloud apps will become more pervasive among hotels, entertainment venues as resorts and sports arenas aim to deliver more personalized experiences to better differentiate their services against Airbnb and home-entertainment options.

Top 10 Hospitality Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Hospitality software providers included in the report are: 7shifts, Atlassian, Agilysys, Autodesk, Avalara, BirchStreet Systems, Buyers Edge Platform, Constellation Software Inc., Cornerstone OnDemand, Cvent, Dayforce, Dropbox, DocuSign, Emplifi, Epicor, Eventbrite, Fiserv, Fourth Enterprises, Global Payments Inc., Genesys Telecommunications Laboratories, Google, Harri US LLC, HireRight, HubSpot, IBM, IBS Software Services, Infor, Intuit Inc., Jolt Software, Medallia, MINDBODY, MYOB, Open Text Corporation, Partech, Paycom, Quinyx, Revinate, RingCentral, Roper Technologies, Sage, ServiceNow, Shiji, Skillsoft, SurveyMonkey, SAS Institute, Travelport, Workday, Xero, Zendesk, Zoho Corp., Zoom Video Communications, and others.

Vendor Snapshot: Hospitality Market Leaders

Salesforce

Salesforce

With Einstein and Agentforce, Salesforce embeds autonomous AI agents that assist with lead response, conversational sales (e.g. RFP proposals), predictive personalization, and guest service support—enabling hospitality brands to scale operations while maintaining tailored engagement.

Adobe

Adobe has introduced AI agents through its Experience Platform Agent Orchestrator, enabling Journey Optimizer and Experience Manager to autonomously diagnose performance issues, generate content variations, orchestrate campaigns, and personalize guest experiences based on behavioral and profile data.

Microsoft

Dynamics 365 Business Central, often paired with hospitality-specific extensions like LS Central, supports end-to-end operations by streamlining reservations, inventory, point-of-sale, and fixed-asset management. Microsoft Power BI enhances decision-making with AI-driven dashboards that track key metrics such as occupancy rates, revenue per available room, and guest behavior. Microsoft further integrates AI capabilities through Copilot and Microsoft 365 Business Chat to automate multilingual guest communications, workflow routing, personalized messages, and financial reporting across hotel operations.

Amadeus

Amadeus Hospitality’s suite support thousands of hospitality businesses globally with integrated tools for operations, marketing, and event sales. TravelClick, acquired by Amadeus in 2018, continues to innovate with AI-powered features like Campaign Advisor and Guest Messenger, using machine learning to optimize marketing send times and automate guest query responses via chatbots . Delphi’s latest release enhances group sales and event planning with a modern UI built on Salesforce’s Einstein 1 platform, plus tools like Delphi Direct for online group booking and integration with MeetingBroker to streamline RFP responses.

Oracle

Oracle has embedded AI into OPERA Cloud through Nor1 PRIME, enabling real-time upsell offers during pre-arrival and check-in to enhance guest personalization and drive incremental revenue. Adoption of OPERA Cloud Central grew 31% year-over-year, now used by over 3,500 hotels, while integration with Simphony POS unifies guest profiles and operational data across the hospitality ecosystem.

Workday

Workday’s retail and hospitality segment has exceeded US $1 billion in annual recurring revenue, with more than 60% of Fortune 500 hospitality companies leveraging its suite. The platform integrates AI and machine learning to improve workforce intelligence and financial planning, with HCM offering AI-powered tools that deliver managerial insights on team dynamics, skills, and scheduling for frontline staff. The 2024 acquisition of Evisort enhances Workday’s capabilities with document intelligence and contract management AI, helping hospitality organizations automate spend management, compliance, and contract workflows across workforce and finance domains.

SAP

SAP Concur Expense utilizes generative AI to automate expense reporting, including hotel receipt itemization and intelligent cost estimates for trip planning, thereby streamlining financial processes for hospitality organizations. SAP SuccessFactors Employee Central incorporates AI-powered tools that deliver managerial insights on team dynamics, skills, and scheduling for frontline staff, enhancing workforce management in the hospitality sector. SAP S/4HANA’s 2024 updates introduce improved user experiences and advanced analytics, enabling hospitality businesses to optimize operations and support data-driven decision-making.

Shiji Group

Shiji ReviewPro Reputation now incorporates AI-driven response generation, allowing hoteliers to create context-aware replies aligned with brand tone and guest sentiment, thereby enhancing efficiency and personalization in guest engagement. Infrasys Cloud POS has added mobile ordering and advanced business intelligence capabilities, improving staff mobility and delivering real-time insights into food and beverage operations. Daylight PMS has enhanced its Single Guest Profile feature, centralizing guest data across properties to support personalized service and streamline operations.

UKG

UKG Pro Workforce Management and UKG Pro Timekeeping offer AI-enhanced tools widely used in the hospitality sector, featuring tailored capabilities for workforce management and labor optimization. The platforms leverage real-time analytics and predictive workforce planning to help reduce labor costs and improve employee engagement, addressing the industry’s high turnover and fluctuating staffing needs. These cloud-based solutions are adopted by over 80,000 organizations worldwide, including many in hospitality, supporting data-driven operational efficiency.

Constellation Software

Constellation Software’s hospitality portfolio comprises Aptech’s PVNG, Targetvue, and Execuvue, supporting over 3,500 properties across North America by integrating financial management, budgeting, and business intelligence with AI-driven automation and analytics. PVNG delivers cloud-based accounting with automated invoice processing and multi-property management, while Targetvue consolidates real-time revenue data from PMS and POS systems to facilitate dynamic forecasting and variance analysis. Seekom, acquired by Jonas Software in 2021, offers a cloud-based PMS and channel management platform focused on dynamic pricing, booking management, and multi-channel integration.

ARTW Technographics Platform: Hospitality customer wins

Since 2010, our research team has been studying the patterns of Hospitality software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Hospitality customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Hospitality customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Hospitality Applications market are available:

- Top 850+ Hospitality Applications Vendors and Market Forecast 2024-2029

- 2024 Hospitality Applications Market By Functional Market (16 Markets)

- 2024 Hospitality Applications Market By Country (USA + 45 countries)

- 2024 Hospitality Applications Market By Region (Americas, EMEA, APAC)

- 2024 Hospitality Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Hospitality Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Hospitality Applications Market By Channel (Direct vs Indirect)

- 2024 Hospitality Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Hospitality Software Vendors, Market Size & Forecast

Q1. What is the global Hospitality software market size in 2024?

A: The global Hospitality software market was $9.6 billion in 2024, growing 11.9% year-over-year.

Q2. Who are the top 10 Hospitality software vendors in 2024 and what share do they hold?

A: The top 10 vendors are Salesforce, Adobe, Microsoft, Amadeus, Oracle, Workday, SAP, Shiji Group, UKG, and Constellation Software, and together they account for 40.8% of the Hospitality software market.

Q3. Which vendor leads the Hospitality software market in 2024?

A: Salesforce leads the market with about 8.6% market share.

Q4. What is the forecast for the Hospitality software market through 2029?

A: The market is projected to reach $13.0 billion by 2029, growing from $9.6 billion in 2024 at a 6.1% compound annual growth rate (CAGR).

Q5. What functions are included in the scope of Hospitality software in this report?

A: It includes Property Management, Cash Journaling & Gratuity Automation, Revenue Optimization, Hotel distribution, CRS/Channel management, Inventory Management, Financials, HR, POS, and Procurement.

Q6. What portion of the Hospitality software market is controlled by the top 10 vendors in 2024?

A: The top 10 vendors control 40.8% of the Hospitality software market in 2024.

Q7. When was this Hospitality software report published and by whom?

A: The report was published in July 2025 by APPS RUN THE WORLD analysts, as part of the APPS TOP 500 research program, which benchmarks revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Fordham University, a United States based Education organization with 2500 Employees

- Royal Cyber, a United States based Professional Services company with 1800 Employees

- Qatar Airways, a Qatar based Transportation organization with 55000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Salesforce

Salesforce