In 2024, the global Government software market grew to $26.7 billion, marking an 11.8% year-over-year increase. The top 10 vendors accounted for 44.6% of the total market. Microsoft led the pack with a 17.7% market share, followed by Tyler Technologies, SAP, and Oracle.

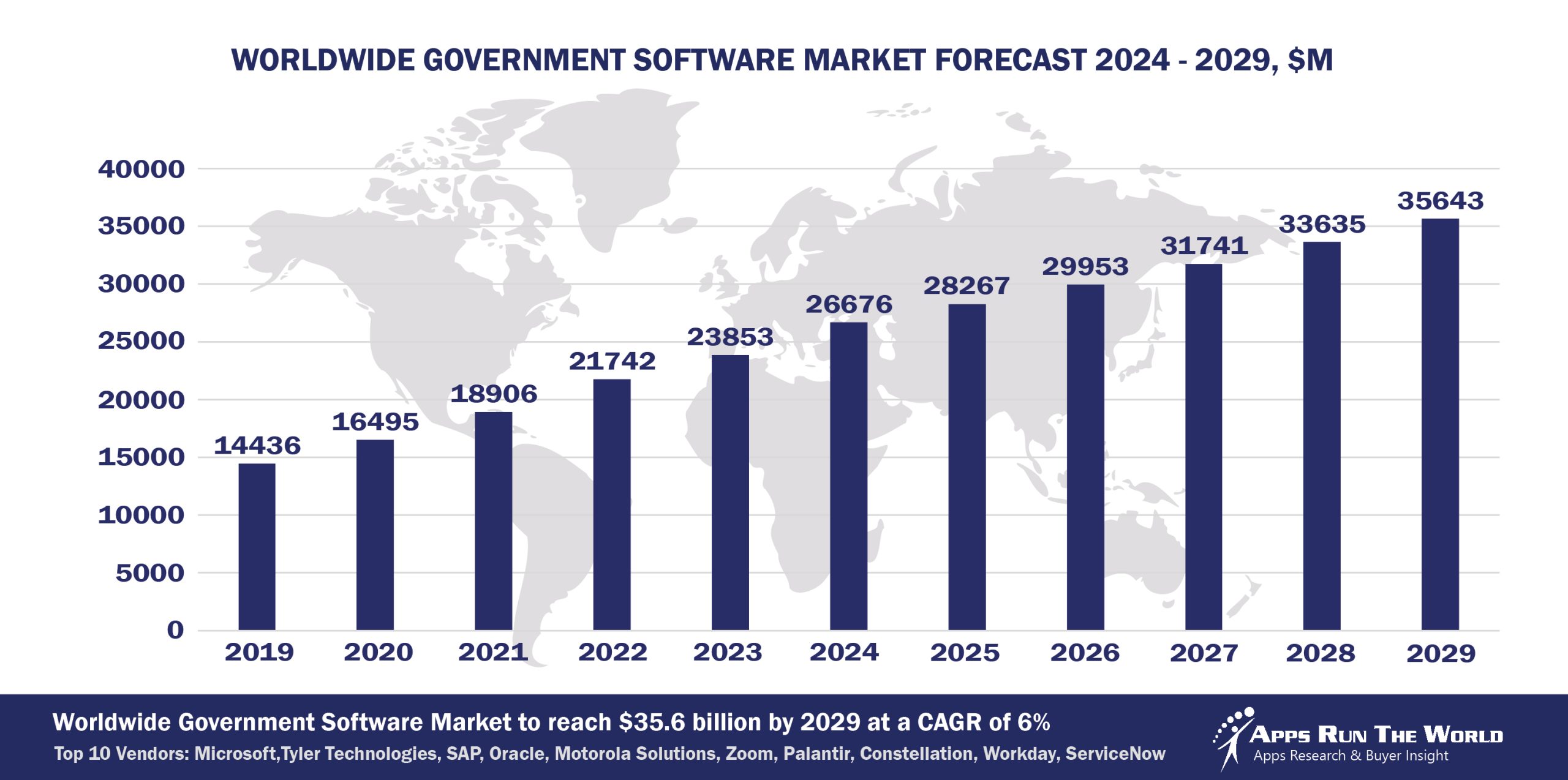

Through our forecast period, the Government applications market size is expected to reach $35.6 billion by 2029, compared with $26.7 billion in 2024 at a CAGR of 6%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Government (Federal, state and local government agencies, nonprofit) – Public Safety Software, Grants and performance management, Computer Assisted Dispatch, Jail Management, Courts Management, Tax Collections, Records Management, Financials, HR, Procurement

e-Government is the catalyst for new system purchases especially among developing countries. Apps designed to improve tax revenue collection will continue to take precedence over other front-office systems.

Top 10 Government Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Government software providers included in the report are: Accela, ACI Worldwide, Inc., Adobe, ADP, Advanced, Asseco Group, Atlassian, Avue Technologies, Berger-Levrault, Blackbaud, Blackboard, Capita Software, Cegid, Celayix Software, CentralSquare Technologies, Dayforce, Cisco Systems, Citrix, Computer Modeling Group, Dileoz, Dropbox, FIS Global, Fiserv, Google, Granicus, Hexagon, Informatica, Intime Solutions, Itineris, Ivanti, Kofax, Laserfiche, NEOGOV, Nice Systems, Oleeo, Open Text Corporation, PROACTIS Group, Roper Technologies, Inc., Salesforce, ServiceNow, Silverlake Axis, Squiz, Serviceaide, TeamDynamix, Teradata Corporation, TMA Systems, UNIT4, Visma, Vitech Systems Group, Workday, XCD HR Limited, Zoom Video Communications, and others.

Vendor Snapshot: Government Market Leaders

Microsoft

Microsoft

Microsoft supports government operations through Microsoft 365, Teams, SharePoint, Power BI, and Dynamics 365 platforms with application across case management, finance, and citizen services. Integrated AI assistants like Copilot help automate reports, compliance checks, and secure collaboration, while Azure’s analytics and Intune deliver device and identity governance for public sector deployments. Continued investment in sovereign cloud, Power Platform low-code workflows, and sector-specific data models further enable scalable modernization in government workflows.

Tyler Technologies

Tyler’s suite, including Munis, Incode, New World, and Citizens Self Service, is evolving with embedded AI features such as priority-based budgeting and document redaction powered by its acquisition of Computing System Innovations (CSI). The company enhances public sector operations via AI-enabled data automation in government finance and courts, and continues deliberative expansion of citizen-facing services. Tyler’s product roadmap emphasizes integrated civic engagement tools and secure cloud deployment for local and state governments.

SAP

For government clients, SAP advances its offerings via S/4HANA, Concur, SuccessFactors, Ariba, and IBP with AI-driven demand forecasting, expense control, and workforce analytics tailored to public administration. Its Business Technology Platform supports intelligent process automation, risk scoring, and regulatory workflow orchestration integrated across finance, HR, procurement, and planning modules. SAP continues expanding with targeted industry cloud investments to support transparent, data-driven public services.

Oracle

Oracle delivers end-to-end government ERP, HCM, EPM, and analytics via its government cloud and NetSuite offerings, embedding AI-driven budget forecasting, citizen journey analytics, and case management workflows. Partnerships with digital agencies and public sector integrators support deployed use cases such as benefits administration and procurement automation. Oracle’s approach emphasizes secure cloud microservices and platform extensibility for regulated government environments.

Motorola Solutions

Motorola’s CommandCenter suite is used extensively by police, fire, and emergency agencies, with recent enhancements such as AI-based incident prediction and real-time resource mapping. Machine learning models process multi-source data to support field operations, dispatch optimization, and situational awareness. Recent platform updates emphasize edge analytics, cloud-native CAD systems, and secure mobile access to critical incident data for faster frontline decision-making.

Zoom Video Communications

Zoom remains a widely adopted platform in government for digital hearings, public consultations, and internal collaboration. Its platform now incorporates AI-based transcription, meeting summarization, and audio optimization features to support accessibility, transparency, and compliance in public sector settings. Recent updates emphasize secure cloud architecture, FedRAMP-authorized deployments, and expanded integrations with case management and civic engagement tools tailored for government workflows.

Palantir Technologies

Palantir’s Foundry platform has expanded in government contracts, including a $10 billion enterprise agreement with the U.S. Army to use AI and data fusion tools for agency-wide workflows. Recent capabilities include the Machinery application for real-time process modeling and the Model Context Protocol (MCP) to enable AI agents to autonomously build and manage cross-agency data pipelines. Collaborations with Accenture Federal Services support scalable deployment of AI-powered data governance and operational transformation in federal agencies.

Constellation Software Inc.

CSI Harris provides public sector-enterprise suites like SmartFusion, CitySuite, and MyGovHub—focused on administration, profiling, and citizen portals. Innovation in areas such as digital licensing, permit automation, and identity validation has been driven through targeted acquisitions and development within its vertical business units. CSI Harris continues delivering government-specific platforms with secure, compliant workflow automation capabilities.

Workday

Workday’s Government Cloud extends its HCM, financial management, and planning applications with AI-enhanced workforce modeling, grant management, and policy workflow automation. Emerging investments in agentic assistants and integration with performance analytics increasingly support public sector planning and staffing needs. Workday’s expansion underlines its strategy to deliver secure, cloud-native platform services for government HR and financial operations.

ServiceNow

ServiceNow’s Public Sector Digital Services and ITSM offer modular workflow automation for government, including permit issuance, case management, and citizen service requests. The platform embeds AI-driven triage, virtual agents, and analytics for service resolution and operational reporting. ServiceNow deepens sector specialization through continued investment in government-specific applications and integration frameworks.

ARTW Technographics Platform: Government customer wins

Since 2010, our research team has been studying the patterns of Government software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Government customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Government customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Government Applications market are available:

- Top 800+ Government Applications Vendors and Market Forecast 2024-2029

- 2024 Government Applications Market By Functional Market (16 Markets)

- 2024 Government Applications Market By Country (USA + 45 countries)

- 2024 Government Applications Market By Region (Americas, EMEA, APAC)

- 2024 Government Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Government Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Government Applications Market By Channel (Direct vs Indirect)

- 2024 Government Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Government Software Vendors, Market Size & Forecast

Q1. What is the global Government software market size in 2024?

A: The global Government software market reached $26.7 billion in 2024, marking an 11.8% year-over-year increase.

Q2. Who are the top 10 Government software vendors in 2024 and their combined share?

A: The top 10 vendors are Microsoft, Tyler Technologies, SAP, Oracle, Palantir Technologies, IBM, Infor, Accenture, SAS Institute, and CGI Group, together accounting for 44.6% of the total Government software market.

Q3. Which vendor leads the Government software market in 2024?

A: Microsoft leads the Government software market in 2024 with a 17.7% market share.

Q4. What is the forecast for the Government software market through 2029?

A: The market is projected to reach $35.6 billion by 2029, growing at a compound annual growth rate (CAGR) of 6%.

Q5. What applications are included in the scope of the Government software market?

A: The scope includes Public Safety Software, Grants and Performance Management, Computer Assisted Dispatch, Jail Management, Courts Management, Tax Collections, Records Management, Financials, HR, and Procurement.

Q6. Which other Government software vendors are covered beyond the top 10?

A: The report also profiles vendors such as Tyler Technologies, SAP, and Oracle, among others, offering specialized solutions for government agencies.

Q7. When was this Government software report published and by whom?

A: The Top 10 Government Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Permira Advisers, a United Kingdom based Banking and Financial Services organization with 502 Employees

- Acuity Knowledge Partners, a United Kingdom based Professional Services company with 6000 Employees

- Acuity Knowledge Partners, a United Kingdom based Professional Services organization with 6000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft