In 2024, the global Customer Relationship Management (CRM) market grew to $80 billion, marking a 10.5% year-over-year increase. The top 10 vendors accounted for 54.2% of the total market, with Salesforce leading the pack with a 26.1%, followed by Adobe, Hubspot, Oracle, and SAP.

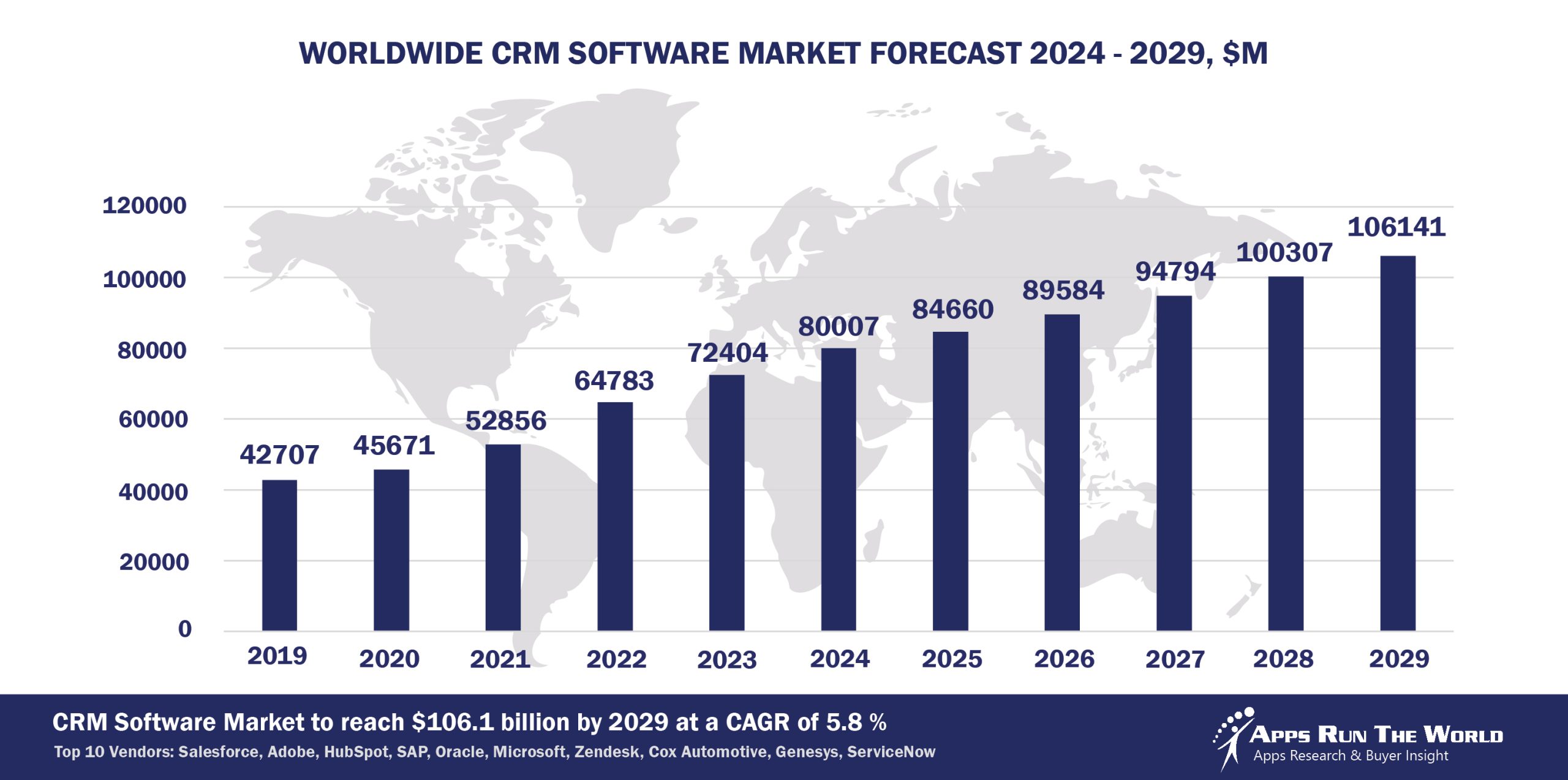

Through our forecast period, the CRM applications market size is expected to reach $106.1 billion by 2029, compared with $80 billion in 2024 at a CAGR of 5.8%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Customer Relationship Management includes applications for sales force automation, marketing automation, customer service and support management such as email automation. Social Media Management, Customer Experience Management, Activity and Participant Management are among some of the newly available CRM applications available via Cloud delivery.

Here are the rankings of the top 10 CRM software vendors in 2024 and their market shares.

Source: Apps Run The World, July 2025

Other CRM software providers included in the report are: 8×8, Act-On Software, AdRoll, Amdocs, Aurea, Avaya, Backbase, Bazaarvoice, Blackbaud, BounceX, Capillary Technologies, CAS Software AG, CDK Global, Cision, Conga, Constant Contact, Constellation Software Inc., Creatio (formerly bpm’online), CSG Systems International, Deluxe Corporation, eGain Corporation, Enghouse Interactive Inc., Fiserv, Five9, Freshworks (formerly Freshdesk), Hansen Technologies, Hootsuite, Infor, InMoment, Intense Technologies, IQVIA, Keap, Khoros, LiveChat Inc., LivePerson Inc., Marin Software, Maropost, Maximizer Software Inc., Medallia, Meltwater Group, Mitel, NCR Corporation, Operative, Puzzel, Quadient, Reynolds and Reynolds Company, RingCentral, Sage, SAS Institute, Sprinklr, SugarCRM, Talkdesk, TTEC, Twilio, Veeva Systems Inc., Vocalcom, Vonage, Zoho Corp., and many others.

Vendor Snapshot: CRM Market Leaders

Salesforce

Salesforce

Salesforce is redefining CRM as a platform for digital labor through its Agentforce architecture, now in its third generation. Agentforce 3 introduces centralized observability and performance governance, enabling leaders to monitor agent-driven processes at scale. The latest capabilities allow autonomous agents to proactively execute sales and service actions, update CRM fields, and coordinate marketing campaigns across multimodal interfaces. These agents are integrated into enterprise workflows with full compliance and runtime monitoring. Enhanced no-code tools support widespread adoption, and Salesforce’s recent acquisition of Informatica strengthens data-agent synergies, reinforcing its positioning as an AI-native CRM platform for regulated, data-intensive industries.

Adobe

Adobe continues to embed agentic AI across its marketing and customer engagement platforms, positioning AI agents as core operators within personalization, campaign orchestration, and content generation. These agents autonomously analyze customer journeys, optimize creative decisions, and generate adaptive experiences in real time. Built on Firefly generative models and real-time CDP infrastructure, Adobe’s low-code design tools empower teams to build intelligent workflows that span marketing, commerce, and analytics. The roadmap emphasizes integrated decisioning across touchpoints, with agents designed to act on signals rather than wait for user prompts—establishing Adobe as a leader in AI-augmented CRM for content-rich environments.

HubSpot

HubSpot is scaling its Breeze AI architecture as a foundational agentic layer across CRM, marketing, and service functions. Pre-built agents now handle lead routing, ticket resolution, and campaign coordination, all managed via no-code builders and governed through a centralized interface. HubSpot’s latest platform updates include autonomous customer service agents and knowledge base augmentation that reduces time to resolution. With its AI agents embedded natively within its unified interface, HubSpot is transitioning from workflow automation to context-aware digital agents capable of evolving through usage patterns. The platform strategy now emphasizes embedded intelligence, composability, and rapid deployment by non-technical users.

SAP

SAP is integrating agentic AI into its Customer Experience suite by combining operational and experience data across its Business Technology Platform. Agents assist with sales pipeline execution, customer service resolution, and journey orchestration through contextual intelligence and cross-system automation. With SAP Build, business teams can design no-code agents that trigger intelligent actions across ERP, marketing, and commerce stacks. SAP’s roadmap focuses on end-to-end automation with embedded governance, enabling enterprises to unify lead-to-cash processes using scalable and composable AI systems that operate securely within enterprise architectures.

Oracle

Oracle is embedding agentic capabilities across its CRM portfolio by enabling context-aware digital agents that analyze data, retain conversation history, and generate real-time decisions. Through AI Agent Studio, Oracle supports advanced reasoning with minimal configuration, allowing these agents to function autonomously across sales, marketing, and service. The platform’s architecture merges agent design with cloud-native infrastructure, bringing agentic automation into the core of CRM execution. Oracle’s roadmap prioritizes embedded agents within enterprise workflows, enabling continuous learning and optimization without disrupting existing business processes.

Microsoft

Microsoft Dynamics 365 is progressing toward agent-led CRM by integrating autonomous capabilities into its Copilot Studio. These agents operate across service, sales, and marketing to understand intent, manage interactions, and trigger process automation. Low-code tools allow for easy configuration, while integration with Microsoft 365 embeds CRM intelligence within productivity workflows. The platform strategy emphasizes scalability and governance, treating agents as native participants in business logic and execution. Dynamics is evolving into a fully AI-native CRM suite where intelligent agents augment human roles and independently drive value across the enterprise.

Zendesk

Zendesk is shifting from reactive customer support to proactive agent-driven operations by embedding generative and agentic AI into its service stack. AI agents autonomously manage inquiries, resolve repetitive issues, and assist human agents with summaries and next-best actions. Recent enhancements integrate low-code agent design tools, allowing business teams to deploy and refine conversational workflows. The strategy emphasizes practical adoption for mid-market and enterprise teams, enabling scaled support operations with minimal manual intervention. Zendesk’s roadmap positions it as a modular, agentic CRM platform optimized for customer service transformation.

Cox Automotive

Cox Automotive is applying agentic AI to automotive CRM by leveraging real-time data from vehicle lifecycles and inventory systems. Agents autonomously enrich leads, monitor dealership stock, and trigger follow-up actions with prospective buyers. By embedding intelligent agents into campaign automation, VIN tracking, and customer engagement, Cox is transforming traditional CRM into a responsive, data-driven ecosystem. Its platform strategy reflects a convergence of mobility insights, sales intelligence, and autonomous digital outreach tailored for the automotive industry.

Genesys

Genesys is enhancing its customer experience platform with AI agents that independently manage customer conversations and workflows across digital and voice channels. These agents draw from historical interactions to personalize responses and improve over time, while orchestration tools allow business users to define and refine behaviors without code. Genesys agents handle routing, resolution, and summarization, creating autonomous service loops that reduce reliance on human intervention. Backed by a $1.5 billion investment from Salesforce and ServiceNow, Genesys platform supports autonomous routing, conversation summarization, and real-time recommendations, enabling enterprises to scale personalized service with minimal agent involvement.

ServiceNow

ServiceNow is embedding agentic intelligence into its Customer Service Management suite, enabling autonomous triage, assignment, and resolution of service issues. Agents operate across front and back-office systems by accessing enterprise data in real time, guided by intent recognition and predefined workflows. No-code and pro-code design options support flexibility in agent development, allowing business teams to deploy domain-specific automations. The strategy centers on integrating intelligent agents within enterprise-wide operations, turning service management into a continuous loop of detection, decision, and action.

ARTW Technographics Platform: CRM customer wins

Since 2010, our research team has been studying the patterns of CRM software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of CRM customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of CRM customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the CRM Applications market are available:

- Top 400+ CRM Applications Vendors and Market Forecast 2024-2029

- 2024 CRM Applications Market By Industry (21 Verticals)

- 2024 CRM Applications Market By CRM Segments and Categories

- 2024 CRM Applications Market By Country (USA + 45 countries)

- 2024 CRM Applications Market By Region (Americas, EMEA, APAC)

- 2024 CRM Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 CRM Applications Market By Customer Size (revenue, employee count, asset)

- 2024 CRM Applications Market By Channel (Direct vs Indirect)

- 2024 CRM Applications Market By Product

Worldwide Enterprise Application Market

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2024-2029 by Functional Market, $M

Source: Apps Run The World, July 2025

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like eCommerce, Enterprise Performance Management, Sales Performance Management and Treasury and Risk, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, CRM and PLM.

FAQ – APPS RUN THE WORLD Top 10 CRM Software Vendors, Market Size & Forecast

Q1. What is the global CRM software market size in 2024?

A: The global CRM software market was $80 billion in 2024, growing 10.5% year‑over‑year as organizations expanded investment in sales, service, and marketing automation.

Q2. Who are the top 10 CRM vendors in 2024 and their combined share?

A: The top 10 CRM vendors are Salesforce, Adobe, HubSpot, Oracle, SAP, Microsoft, Zendesk, Cox Automotive, Genesys, and ServiceNow, together holding 54.2% of the CRM market.

Q3. Which vendor leads the CRM software market in 2024?

A: Salesforce leads the CRM market with approximately 26.1% market share in 2024.

Q4. What is the forecast for the CRM software market through 2029?

A: The CRM market is projected to reach $106.1 billion by 2029, growing at a 5.8% CAGR from 2024.

Q5. What kinds of applications are included in the CRM market scope in this report?

A: The scope includes sales force automation, marketing automation, customer service and support management, plus newer cloud‑delivered functions such as social media management, customer experience, and activity tracking.

Q6. Which other CRM vendors are covered beyond the top 10?

A: The report also profiles additional CRM vendors like Zoho, Freshworks, Pipedrive, SugarCRM, Keap, Insightly, and others serving the mid‑market and specialized verticals.

Q7. When was this report published and by whom?

A: The Top 10 CRM Software Vendors, Market Size & Forecast 2024‑2029 was published July 23, 2025 by APPS RUN THE WORLD analysts, as part of the APPS TOP 500 research program which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Drexel University, a United States based Education organization with 6471 Employees

- FourNet, a United Kingdom based Professional Services company with 200 Employees

- Clifford Chance, a United Kingdom based Professional Services organization with 3760 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Salesforce

Salesforce