In 2024, the global Healthcare software market grew to $36.3 billion, marking a 9.9% year-over-year increase. The top 10 vendors accounted for 42.8% of the total market. Microsoft led the pack with a 12.1% market share, followed by Oracle, athenahealth, and Salesforce.

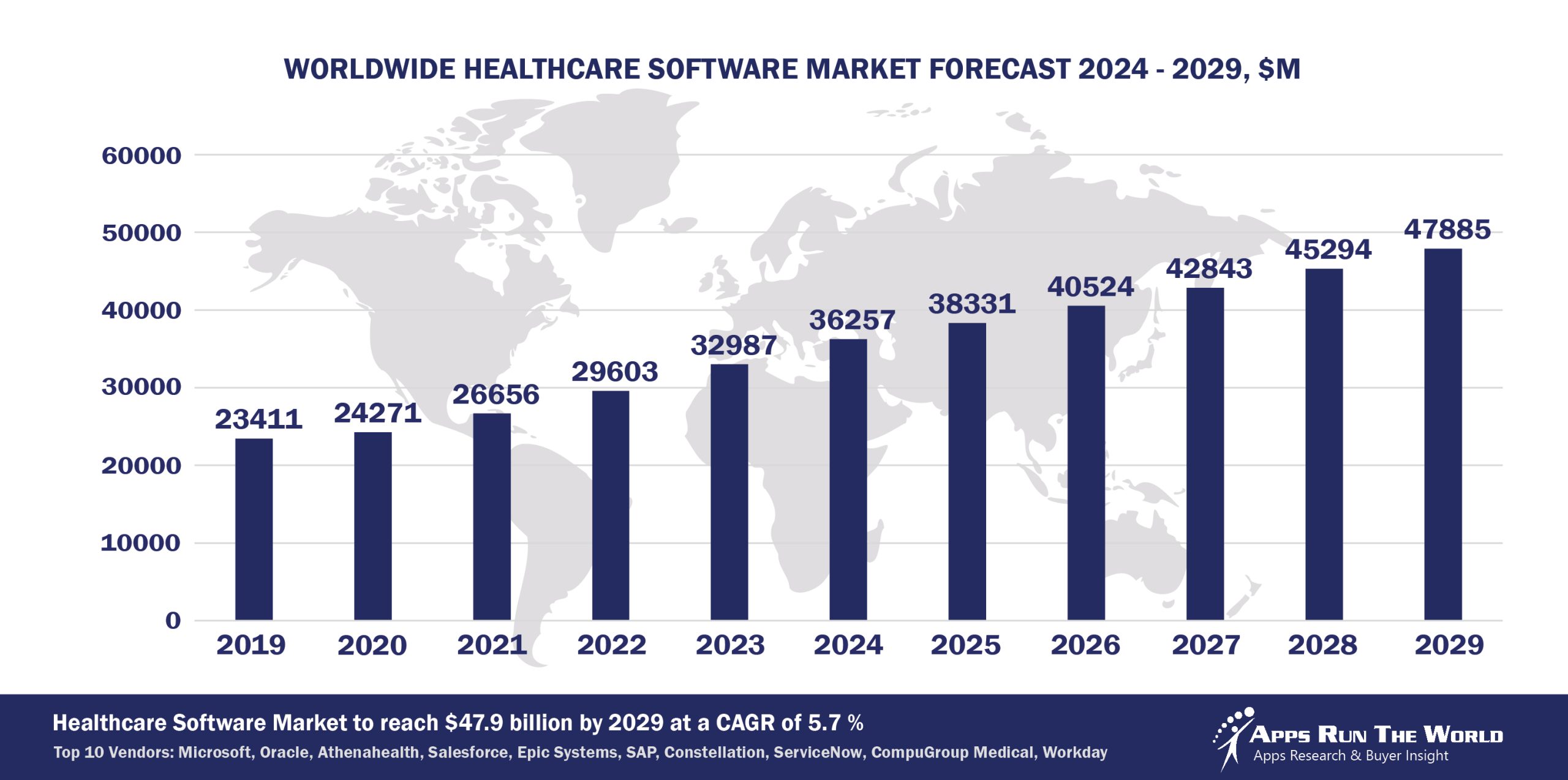

Through our forecast period, the Healthcare applications market size is expected to reach $47.9 billion by 2029, compared with $36.3 billion in 2024 at a CAGR of 5.7%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Healthcare (Healthcare providers, hospitals, physicians, clinics, hospices) – Electronic Health Records, Practice Management, Revenue cycle management, Financials, HR, Procurement

Consolidation among national healthcare providers will accelerate system standardization, while reimbursement cuts, especially by the US government, will prompt regionals to do the same in order to drive costs down. New E-Prescription rules, medical procedure code changes, health record systems will have a profound impact on workflow and revenue cycle management.

Top 10 Healthcare Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Healthcare software providers included in the report are: Adobe, ADP, Ansys Inc., Ascom, Box Inc., Brightree, Cegedim, Cisco Systems, CompuGroup Medical, Computer Programs and Systems Inc, Constellation Software Inc., Cornerstone OnDemand, Craneware plc, DrFirst, Dropbox, eClinicalWorks, Edifecs, Inc, Equifax, Exela Technologies, Inc., Experian Health, Eyefinity, Fiserv, Genesys, Google, Greenway Health, GHX, Gusto, HealthStream, Homecare Homebase, Huron, Hyland, Infor, IQVIA, McKesson, MedeAnalytics Inc, MEDHOST, MEDITECH, Meridian Medical Management, NantHealth, NexTech Systems Inc., NextGen Healthcare, Open Text Corporation, PDS, Qlik, Qualifacts Systems Inc., RingCentral, Roper Technologies, Inc., SAP, SAS Institute, SCC Soft Computer, SDB Ayton, ServiceNow, Siemens Digital Industries Software, SSI Group, TeleTracking Tech Inc., TELUS Health, TMA Systems, UKG, Vizient, Waystar, WebPT, Workday, WellSky, ex Mediware Information Systems, Inc., XIFIN, Zoom Video Communications, and others.

Vendor Snapshot: Healthcare Market Leaders

Microsoft

Microsoft

Microsoft’s Dynamics 365 for Finance and Operations and Power BI play pivotal roles in the healthcare industry by streamlining financial management and delivering advanced analytics for clinical and operational decision-making. Microsoft has integrated AI-driven capabilities such as predictive analytics and automated data visualization within Power BI to enhance patient care insights and operational efficiency.

Oracle

Oracle’s healthcare portfolio, anchored by Oracle Cerner Millennium and complemented by Oracle Cloud ERP, HCM, EPM, and Analytics Cloud, supports comprehensive clinical, financial, and operational workflows for healthcare providers. The integration of AI and machine learning capabilities enhances patient data analysis, predictive care models, and resource optimization across large health systems. Serving thousands of healthcare organizations globally, Oracle’s cloud-based solutions facilitate scalable, data-driven care delivery and enterprise management.

athenahealth

athenaOne’s Ambient Notes feature uses generative AI to automate clinical note creation, helping clinicians spend more time on patient care. Additionally, AI-powered tools such as athenaOne Dictation and Voice Assistant, developed in partnership with Nuance, enhance documentation accuracy through advanced voice-to-text technology.

Salesforce

Salesforce’s Health Cloud, Marketing Cloud, and Service Cloud serve healthcare providers by enhancing patient relationship management, personalized outreach, and service delivery. The integration of Salesforce’s Einstein AI enables predictive analytics, care coordination, and automated workflows, improving patient engagement and operational efficiency.

Epic Systems

In 2024, Epic announced plans to introduce over 100 new AI features, including generative AI tools that help clinicians draft and simplify patient communications, auto-suggest orders, and assist with prior authorization. AI-powered ambient documentation tools, already deployed at more than 70 sites, enable real-time note generation during patient encounters, reducing clinician workload and burnout. Epic’s Cosmos, a large de-identified patient dataset, supports these AI efforts by providing real-world data to train and refine models, enabling personalized care insights and predictive analytics. Additionally, Epic is developing an AI Trust and Assurance suite to validate and monitor AI model performance within specific healthcare environments.

SAP

SAP’s healthcare solutions—including SAP S/4HANA, SAP Analytics Cloud, and SAP SuccessFactors Employee Central—support clinical and operational workflows, workforce management, and advanced data analytics for healthcare providers. SAP Analytics Cloud offers AI and machine learning capabilities that enable predictive analytics and data visualization to improve decision-making.

Constellation Software

Constellation Software, through its subsidiary Harris Computer Corporation, has expanded its healthcare footprint by acquiring key EHR and healthcare IT solutions, including Allscripts’ Hospitals and Large Physician Practices business segment in 2022, valued at up to $700 million. In 2023, Harris further enhanced its portfolio with the acquisitions of MEDHOST, a provider of EHR and healthcare IT solutions, and Amazing Charts, which serves nearly 4,000 medical practices with EHR and practice management software. These strategic acquisitions strengthen Constellation’s position as a notable player in the healthcare software market.

ServiceNow

ServiceNow’s healthcare solutions, including IT Service Management (ITSM) and the Now Platform, leverage AI to enhance operational efficiency and patient care. The Now Platform integrates AI-powered workflows, enabling healthcare organizations to automate tasks, streamline processes, and improve service delivery. ServiceNow’s AI capabilities support predictive analytics, incident management, and resource optimization, contributing to improved IT resilience and patient outcomes.

CompuGroup Medical

CompuGroup Medical (CGM) offers CGM Aprima and CGM Medisoft, electronic health record (EHR) and practice management solutions tailored for small to mid-sized healthcare practices. CGM Aprima integrates ambient AI through CGM AMBI, which listens to patient encounters and auto-generates structured notes, diagnoses, orders, and billing codes, enhancing documentation efficiency and reducing clinician burnout. CGM Medisoft, when bundled with CGM Aprima, provides a comprehensive solution for practice management and EHR needs. CGM’s solutions are utilized by over 1.6 million users across 56 countries, reflecting their widespread adoption in the healthcare sector.

Workday

Workday delivers integrated solutions for healthcare organizations through Workday Financial Management, Workday HCM, and Workday Adaptive Planning. These platforms leverage AI and machine learning to enhance financial operations, workforce management, and strategic planning. Workday’s AI capabilities, embedded across its applications, support predictive analytics, anomaly detection, and data-driven decision-making, enabling healthcare providers to optimize resource allocation, improve operational efficiency, and deliver quality care.

ARTW Technographics Platform: Healthcare customer wins

Since 2010, our research team has been studying the patterns of Healthcare software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Healthcare customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Healthcare customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Healthcare Applications market are available:

- Top 1000+ Healthcare Applications Vendors and Market Forecast 2024-2029

- 2024 Healthcare Applications Market By Functional Market (16 Markets)

- 2024 Healthcare Applications Market By Country (USA + 45 countries)

- 2024 Applications Market By Region (Americas, EMEA, APAC)

- 2024 Healthcare Applications Market By Revenue Type(License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Healthcare Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Healthcare Applications Market By Channel (Direct vs Indirect)

- 2024 Healthcare Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Healthcare Software Vendors, Market Size & Forecast

Q1. What is the global Healthcare software market size in 2024?

A: The global Healthcare software market grew to $36.3 billion in 2024, marking a 9.9% year-over-year increase.

Q2. Who are the top 10 Healthcare software vendors in 2024 and their combined share?

A: The top 10 vendors are Microsoft, Oracle, athenahealth, Salesforce, Cerner (now part of Oracle), Allscripts, Meditech, McKesson, GE Healthcare, and IBM. Together, they accounted for 42.8% of the total market.

Q3. Which vendor leads the Healthcare software market in 2024?

A: Microsoft leads the Healthcare software market in 2024 with a 12.1% market share.

Q4. What is the forecast for the Healthcare software market through 2029?

A: The market is projected to reach $47.9 billion by 2029, growing at a compound annual growth rate (CAGR) of 5.7%.

Q5. What applications are included in the scope of the Healthcare software market?

A: The scope includes Electronic Health Records (EHR), Practice Management, Revenue Cycle Management, Financials, HR, and Procurement.

Q6. Which other Healthcare software vendors are covered beyond the top 10?

A: The report also profiles vendors such as GE Healthcare, McKesson, and IBM, among others, offering specialized solutions for healthcare providers.

Q7. When was this Healthcare software report published, and by whom?

A: The Top 10 Healthcare Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- WellSpan Health, a United States based Healthcare organization with 20000 Employees

- J.P. Morgan, a United States based Banking and Financial Services company with 4649 Employees

- Visionet Systems India, a India based Professional Services organization with 3000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft