In 2024, the global Transportation software market grew to $19.5 billion, marking a 10.3% year-over-year increase. The top 10 vendors accounted for 46.1% of the total market. Microsoft led the pack with a 14.3% market share, followed by Salesforce, Amadeus, and SAP.

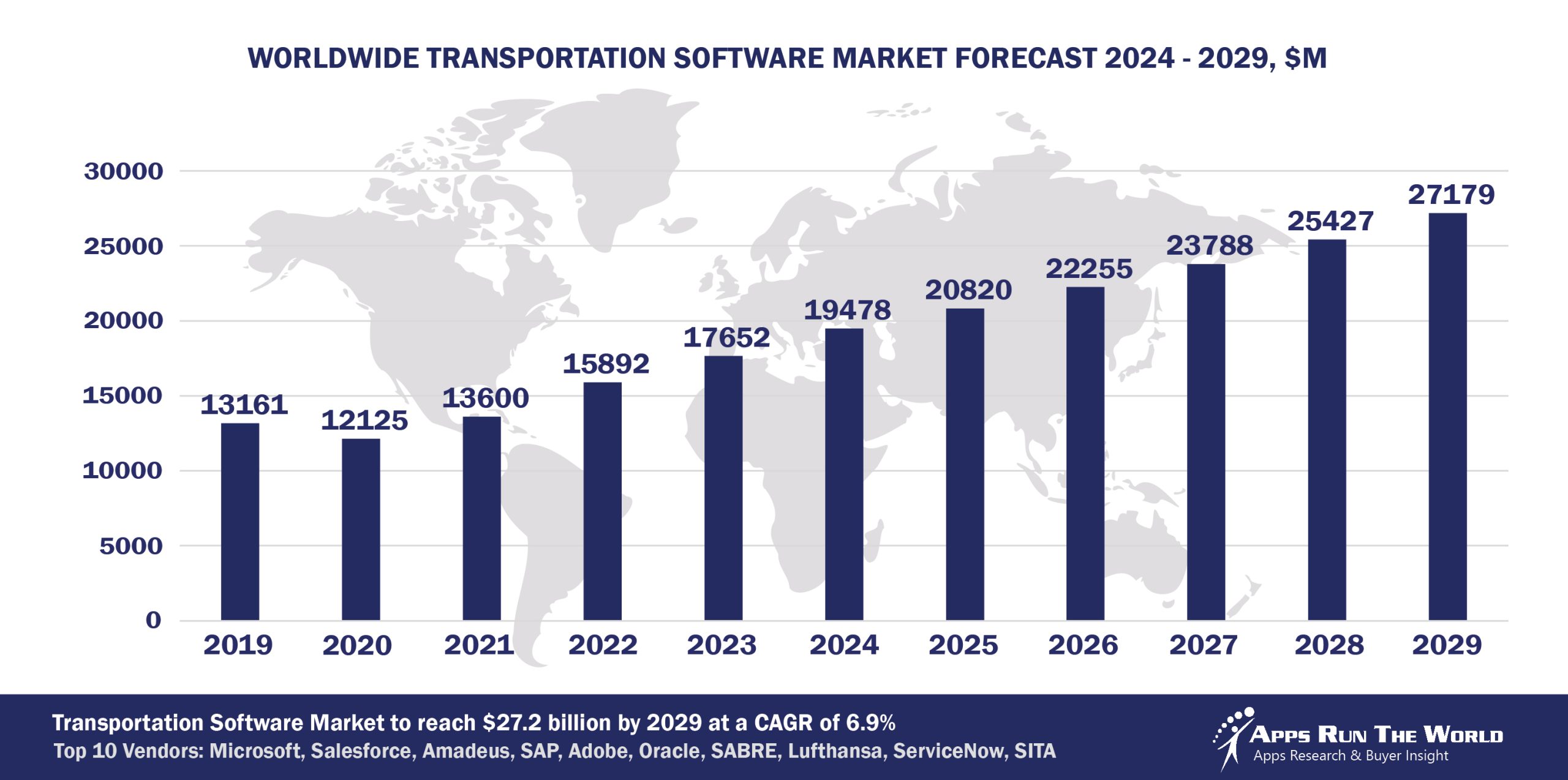

Through our forecast period, the Transportation applications market size is expected to reach $27.2 billion by 2029, compared with $19.5 billion in 2024 at a CAGR of 6.9%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Transportation (Operation of means of moving freight and passengers) – Cargo Management, Airport Management System, Scheduling, Intelligent Transportation, Fare Collection, Ferry reservation systems, Fleet management, Financials, HR, Procurement

Airlines, cruise operators and rails will continue to invest heavily in Customer Experience apps, while a new generation of mobile devices and sensors could remake the trucking vertical, especially in such areas of fleet management, scheduling and environmental health and safety.

Top 10 Transportation Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Transportation software providers included in the report are: ABB’s Enterprise Software Group, Ansys Inc., ADP, Appcast, Inc, Atlassian, Atos (Including Evidian), Autodesk, AVEVA Group, Box Inc., Circadian, Constellation Software Inc., Cisco Systems, Citrix, Dassault Systemes, Dayforce, Descartes Systems Group, DocuSign, Inc., Dominion Leasing Software, Dropbox, Enghouse Interactive Inc., Epicor, Fiserv, Genesys Telecommunications Laboratories, Giro Inc, Google, Hexagon, Hilan, IBM, IBS Software Services, Indra Sistemas, Infor, Info-Tech Systems Integrators Pte Ltd, Intuit Inc., iptor, Kofax, Manhattan Associates Inc., Nakisa, Nice Systems, Open Text Corporation, Optalert Limited, OverIT – Field Solutions, Paycom, Pegasystems, ProAlpha Business Solutions, PROS Holdings, PTC, RingCentral, Roper Technologies, Inc., Sage, Solera Holdings, ServiceNow, Silverlake Axis, SITA, SPS Commerce, Inc., Trimble, Teradata Corporation, Travelport, Twilio, UKG, Verint Systems Inc., Visma, Verizon Connect, Workday, Yonyou, Zoom Video Communications, and others.

Vendor Snapshot: Transportation Market Leaders

Microsoft

Microsoft

Microsoft is extending its Dynamics 365 Transportation Management and Supply Chain modules with AI-driven routing and load-optimization capabilities, leveraging Azure Maps and real-time telematics data to enhance fleet utilization and reduce transit times. The company has integrated Copilot-style assistants across Finance, Operations and Transportation apps to streamline exception handling and customer communications. Recent investments in edge computing and sensor-to-cloud platforms reinforce Microsoft’s focus on end-to-end visibility and predictive maintenance for transportation operators.

Salesforce

Salesforce applies its Sales, Service and Marketing Clouds to transportation by unifying customer, partner and service data, enabling carriers and logistics providers to automate booking, issue resolution and personalized communications. Einstein AI and Agentforce drive predictive delay notifications and dynamic service routing, while Transportation and Logistics Cloud introduces industry-specific data models and pre-built connectors to fleet telematics and reservation systems for real-time asset visibility. Data Cloud integrations bring together CRM, IoT telemetry and operational insights to enhance end-to-end transportation workflows.

Amadeus

Amadeus is enhancing its Travel Platform and Altea Departure Control with machine-learning-powered passenger flow forecasting and dynamic seat-allocation algorithms to improve on-time performance and load balancing. Its investment in cloud-native Open APIs and AI-based disruption management tools helps airlines and ground handlers react faster to irregular operations. Amadeus has bolstered its retailing capabilities through the acquisitions of Vision-Box for biometric identity services and Voxel for digital payments, integrating seamless boarding and on-site transaction experiences into its core operations.

SAP

SAP Transportation Management now incorporates predictive freight cost analytics and AI-based carrier selection to optimize multimodal logistics and reduce shipping spend. Powered by the Business Technology Platform, it connects with S/4HANA for seamless order orchestration and yard management. The company’s strategic investment in its Logistics Business Network expands collaborative planning and execution across global logistics partners.

Adobe

Adobe Experience and Analytics Clouds serve transportation firms by delivering journey-based marketing orchestration, real-time customer insights and behavioral targeting for passenger and cargo services. Its Sensei AI automates segmentation and route-based promotional offers, enhancing load factor and ancillary revenue. Adobe’s acquisition of behavioral analytics and customer-data platforms has enriched its ability to unify digital and operational data for cross-channel engagement.

Oracle

Oracle Transportation Management System now embeds AI-driven capacity forecasting and dynamic routing engines within its Cloud ERP suite to streamline order management and carrier settlement. The platform integrates with Transplace and other leading logistics networks via prebuilt connectors to enhance real-time visibility and tender optimization across road, rail and intermodal operations. Oracle continues to invest in its Autonomous Database and cloud-native microservices to drive scalable logistics innovation.

SABRE Corp.

Sabre’s core reservations and Mosaic merchandising platforms have been upgraded with machine-learning models for demand forecasting and personalized offers, helping carriers improve revenue per available seat mile. Sabre Sonic’s transition to a cloud-native architecture supports rapid feature deployment and resilience. Investments in API-first commerce and partnerships with retailing specialists underpin its strategy to modernize passenger distribution channels.

Lufthansa Systems

Lufthansa Systems has enhanced its Lido/Flight navigation databases and NetLine/Crew crew-scheduling suite with AI-powered conflict detection and optimization to improve on-time performance and resource utilization. Its Sirax Revenue Accounting system now features automated revenue reconciliation and predictive cash-flow analysis. The company has prioritized deep integration with operational control centers over recent acquisitions, focusing on joint development with airline customers.

ServiceNow

ServiceNow’s ITSM and Field Service Management solutions are tailored for transportation operators by automating incident resolution, maintenance scheduling and regulatory compliance workflows. The addition of AI-powered Virtual Agents and Predictive AIOps helps carriers proactively detect system faults and optimize resource dispatch. ServiceNow expands its presence via partnerships with telematics and control-tower technology vendors.

SITA

SITA’s Smart Path and Airport Management platforms leverage biometric-driven passenger processing and AI-based flow modeling to reduce wait times and improve gate utilization. Its WorldTracer baggage-tracking system integrates machine-learning algorithms for mishandled-bag prediction and proactive notifications. SITA has refined its portfolio through acquisitions of Materna IPS for self bag-drop and passenger handling, ASISTIM for Operations Control Center services, and CCM for airport interior design expertise.

ARTW Technographics Platform: Transportation customer wins

Since 2010, our research team has been studying the patterns of Transportation software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Transportation customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Transportation customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Transportation Applications market are available:

- Top 950+ Transportation Applications Vendors and Market Forecast 2024-2029

- 2024 Transportation Applications Market By Functional Market (16 Markets)

- 2024 Transportation Applications Market By Country (USA + 45 countries)

- 2024 Transportation Applications Market By Region (Americas, EMEA, APAC)

- 2024 Transportation Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Transportation Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Transportation Applications Market By Channel (Direct vs Indirect)

- 2024 Transportation Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Transportation Software Vendors, Market Size & Forecast

Q1. What is the global Transportation software market size in 2024?

A: The global Transportation software market reached $19.5 billion in 2024, growing 10.3% year-over-year.

Q2. Who are the top 10 Transportation software vendors in 2024 and their combined share?

A: The top 10 vendors are Microsoft, Salesforce, Amadeus, SAP, Adobe, Oracle, SITA, IBM, Infor, and Trimble, collectively accounting for 46.1% of the market.

Q3. Which vendor leads the Transportation software market in 2024?

A: Microsoft leads with a 14.3% market share, driven by its Dynamics 365 Transportation Management and Supply Chain modules.

Q4. What is the forecast for the Transportation software market through 2029?

A: The market is projected to reach $27.2 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.9%.

Q5. What applications are included in the scope of the Transportation software market?

A: The market includes Cargo Management, Airport Management Systems, Scheduling, Intelligent Transportation, Fare Collection, Ferry Reservation Systems, Fleet Management, Financials, HR, and Procurement.

Q6. Which other Transportation software vendors are covered beyond the top 10?

A: Additional vendors profiled include SAP, Oracle, SITA, IBM, Infor, and Trimble, offering specialized solutions for various transportation sectors.

Q7. When was this Transportation software report published, and by whom?

A: The report was published in July 2025 by APPS RUN THE WORLD analysts, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year, our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies they are running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Mitsui O.S.K. Lines, a Japan based Transportation organization with 10500 Employees

- CLSA, a Hong Kong based Banking and Financial Services company with 1800 Employees

- Msquare Technologies, a United States based Professional Services organization with 120 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft